In a fast-paced business environment, automated payroll processing is no longer a luxury; it has become a necessity for businesses looking to survive in today’s dynamic market of Singapore. Over the years, with the evolution of businesses, fundamental changes have been witnessed in the realm of payroll processing. Automation now assumed a key role by driving efficiency and ensuring accuracy.

Evolution of Payroll Processing in Singapore

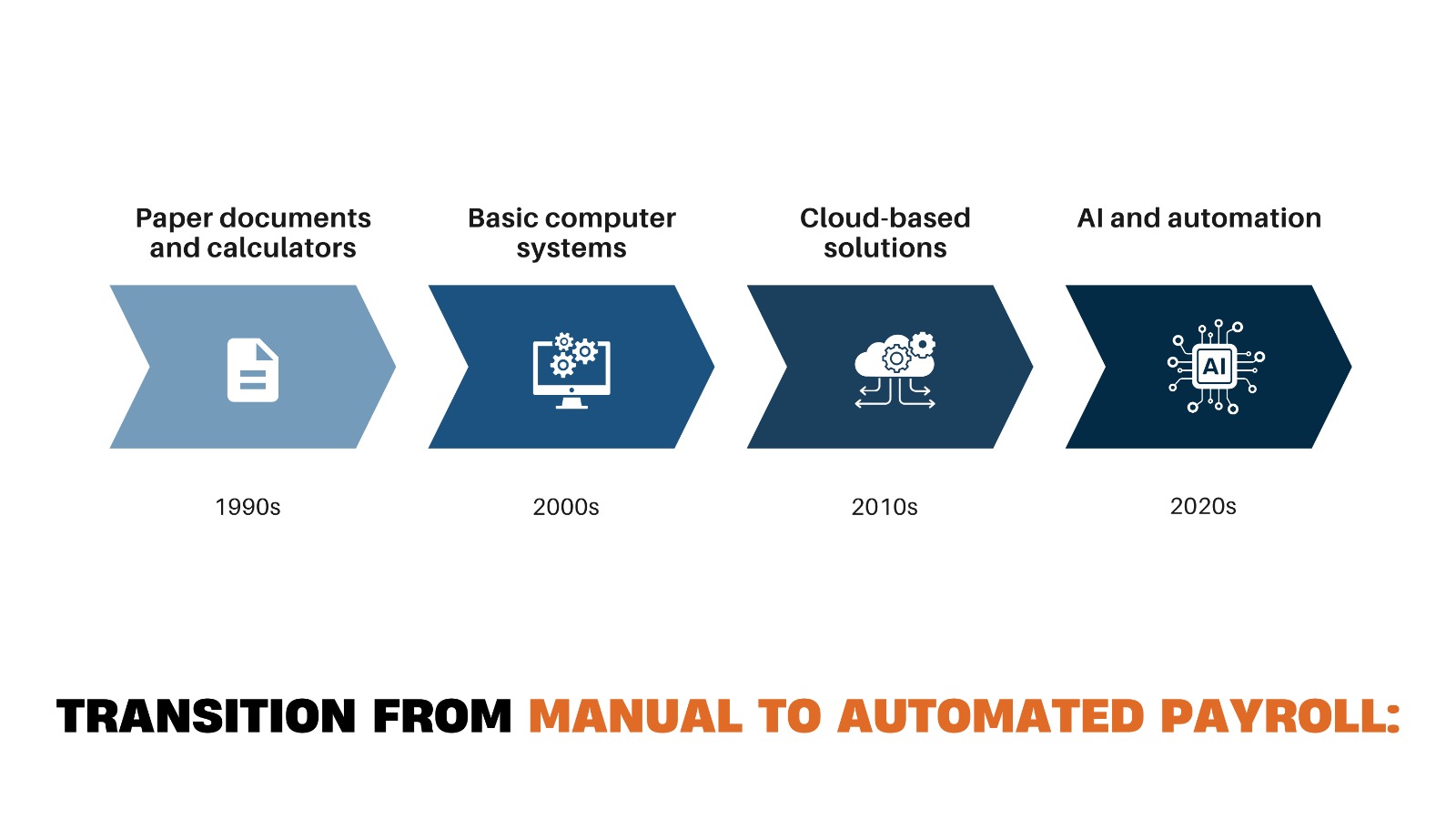

The labour market in Singapore witnessed a significant change over the last 10 years, as indicated by MOM. Earlier functional payroll processing was mostly manual, now elaborate automated systems carry out various tasks, including salary calculation, compliance to laws, etc.

Why Automated Payroll Processing is Important

Saves Time and Resources

An accounting firm in Singapore, KPMG, estimated that automation could reduce the payroll processing time by 70%. This is equivalent to the time saved for the HR to calculate payroll manually and enter it into the payroll systems.

Improved Accuracy and Compliance

According to IRAS, human error in a payroll is one of the biggest causes of discrepancies in tax returns. Automated systems help contain these miscalculations thus enhancing the correctness of:

- Salary calculation

- CPF contribution

- Tax deductions

- Leave entitlement

- Overtime pay

Also Read: What Changes Have Been Made to the Companies Act Recently?

Automated Payroll Processing: How GOHRBPO Transforms Payroll

In Singapore, GOHRBPO has come up as the premier automated payroll solutions service provider, catering to all the varied needs of contemporary business enterprises. Their automated payroll solution submits:

Intelligent Automation Solutions

- End-to-end payroll processing

- Real-time calculation updates

- Automated statutory payments

- Integrated leave management

- Seamless expense processing

Compliance Management

- Automatic updates according to regulatory changes

- Built-in compliance checks

- Real-time calculations validation

- Automated reporting to authorities

Data Security and Analytics

- Advanced encryption protocols

- Secure cloud storage

- Comprehensive audit trails

- Detailed analytics and reporting

Automated Payroll Processing: The Business Impact of Automation

Cost Saving

According to the Singapore Business Federation, payroll automation can produce actual operational cost savings approaching 40%. These GoHRBPO solutions achieve such savings in a very transparent manner through:

- Reduced manual workload

- Reduced cost of any error correction

- Lower compliance risks

- Better use of resources

Employee Satisfaction

Today’s workers want to be able to access their payroll through digital channels. According to Workday Research, 80% of employees would prefer digital access to their payroll information. GOHRBPO’s automated payroll processing includes:

- Self-service portals

- Mobile accessibility

- Real-time access to payment information

- Digital pay slips

Implementation and Integration

Smooth Transition

GOHRBPO enables a seamless transition into automated payroll processing through:

- In-depth system analysis

- Tailor-made implementation

- Training and intendance

- Support and further technical assistance

Integration Capabilities

Their solution integrates neatly with:

- Existing HR management systems

- Accounting software

- Time and attendance systems

- Banking platforms

Also Read: How to File Your Income Tax in Singapore: A Complete Guide for 2024

The Future of Automated Payroll Processing

As Singapore moves ahead with Smart Nation, the evolution of automated payroll processing will be enacted. The Infocomm Media Development Authority has predicted broader adoption of:

- Artificial Intelligence for payroll analysis

- Blockchain for secure transactions

- Predictive analytics for planning for the workforce

- Advance mobile integration

Measuring Success Through Analytics

The automated system offers analytics that will help businesses to:

- Check processing efficiency

- Monitor compliance levels

- Assess savings on costs

- Identify optimization opportunities

- Plan for future workforce requirements

Conclusion

Automated payroll processing, especially through sophisticated solutions such as those offered by GOHRBPO, is a definitive step in the direction of enhanced business efficacy and accuracy. In Singapore’s cut-throat environment, the automation is not only about keeping up but also forging ahead.

Partnering with GOHRBPO, enterprises will benefit from the latest automation technology while remaining compliant with Singapore’s complicated regulatory framework, paving the way for a more efficient, accurate, and cost-effective payroll process, delivering value to both employers and employees.

Automated payroll processing will continue to advance further into the digital age as companies adapt even more sophisticated solutions that address now-changing needs. Those who embrace this transformation now will surely benefit from more available choices towards future success in Singapore’s dynamic business environment.