Payroll Management in Singapore is a major complexity in the current context, especially for those managing agencies with multiple clients and diversified workforce structures. With Singapore carving a niche for itself as a global business hub, the demand for efficient and compliant payroll services spurs like never before.

An Insight into the Payroll Landscape in Singapore

The payroll ecosystem in Singapore is governed by strict regulations and compliance requirements. The Ministry of Manpower (MOM) states that the employers are obliged to essentially observe some guidelines regarding salary payments, CPF contributions, and various statutory requirements. The situation becomes more complex for agencies handling multiple clients as each client has its own specific payroll requirements; thus, it becomes imperative to establish strong payroll systems.

Common Challenges in Agency Payroll Management

Agencies in Singapore experience various challenges when providing payroll services. The most pressing of these is dealing with varying payment structures for different clients. Whether it is a case of full-time employment or versatility in contractors or part-time staff, each type will have a wide range of compliance requirements and calculation methods.

Key Components of Efficient Payroll Services

1. Automation Integration

Following the rapid changes in modern payroll management, automation tools with the highest degree of sophistication should be put into place. And KPMG Singapore stated that automated payroll solutions offer companies the advantage of reducing processing time by as much as 60 percent while minimizing facets of human error.

2. Compliance Management

Staying compliant with employment laws in Singapore is non-negotiable. This includes accurate calculation and timely submission of:

- Central Provident Fund (CPF) contributions

- Skills Development Levy (SDL)

- Personal income tax reporting

- Foreign worker levy (where applicable)

3. Data Security

The Personal Data Protection Act (PDPA) identifies that employee records should be kept private and confidential. Protecting the transmission of payroll data requires rigorous security measures.

Agency Payroll Services In Singapore: Steps To Streamline Your Payroll

Cloud-Based Solutions

A cloud-based payroll management system offers great flexibility and accessibility. According to Infocomm Media Development Authority, cloud adoption in Singapore has increased by 40% since 2020 with payroll management being a target application.

Standardizing Processes

Standard operating procedures must be put into place for:

- Data collection and verification

- Payment processing schedules

- Compliance checking

- Report generation

Audits and Reviews

A few audits should be done to reconcile period figures and ensure compliance with payroll principles and characteristics. Audit goals can lead to early identification of problems related to payroll management. Continuous improvement of those processes can then take place.

Also Read : How to File Your Income Tax in Singapore: A Complete Guide for 2024

Technological Advancements in Payroll Management

Modern payroll solutions offer:

- Real-time capabilities

- Integrated HR management

- Automated tax calculations

- Digital documents

- Mobile accessibility

Cost and ROI

While implementing high-end solutions may involve a substantial cost initially, measurable returns can be realized in the future. According to research conducted by Enterprise Singapore, payroll management systems can save businesses up to 30% in administrative costs.

The Future of Agency Payroll Services

The future of payroll services in Singapore is an increasingly digital one. With this Smart Nation initiative, we already have greater adoption of:

- Artificial intelligence in payroll processing

- Blockchain for secured transactions

- Advanced analytics to facilitate better decision-making

- Integration with other business systems

Choosing the Right Payroll Service Provider

While selecting a payroll service provider in Singapore, consider:

- Experience with the regulatory environment of Singapore

- Technology infrastructure

- Customer support quality

- Scalability options

- Integration capabilities

- Cost structures

Also Read: The Cost of Outsource Payroll: Is It Worth It?

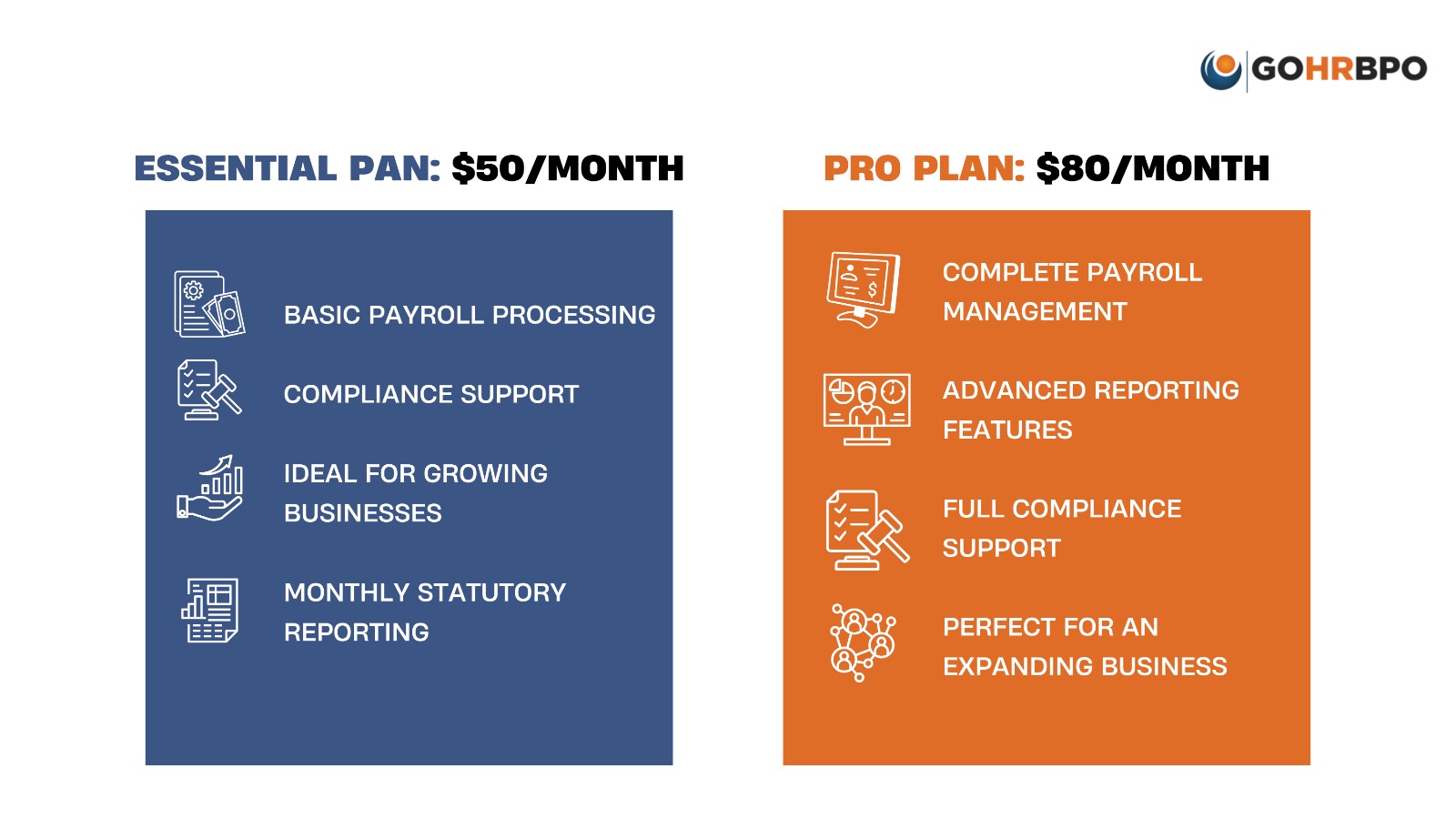

A prime example of a payroll outsourcing service provider in Singapore is GOHRBPO; they combine a number of these essential features along with comprehensive solutions for agencies. Their niche solutions for agency payroll services address:

- Agency-focused solutions for multiple client structures running simultaneously

- Automated systems which integrate seamlessly with the existing HR platforms

- Real-time updates on compliance requirements which take into account Singapore’s evolving regulations

- Customizable reporting features to address various client needs

- Expert support team entrenched in the Mosaic of payroll issues in Singapore

Agencies can benefit by collaborating with a provider like GOHRBPO by getting:

- Reduced administrative workloads enabling focus on core business activities

- Greater accuracy in payroll processing capability

- Established timeliness in compliance with regulations

- Scalability with solutions growing by the agency

Conclusion

Streamlining agency payroll services in Singapore requires a balanced approach combining technology, compliance, and efficient processes. By implementing the right solutions and following best practices, agencies can significantly improve their payroll management while ensuring compliance with local regulations.

The key to success lies in choosing the right combination of tools and services that align with your agency’s specific needs while maintaining the flexibility to adapt to Singapore’s evolving business landscape. Whether you’re managing payroll for a small agency or a large organization, the focus should always be on accuracy, efficiency, and compliance.

Remember, efficient payroll management isn’t just about paying employees on time – it’s about creating a sustainable, scalable system that supports your agency’s growth while maintaining compliance with Singapore’s regulatory requirements.