If you own an enterprise in Singapore it is prudent to avail a preliminary view of the GST filing IRAS (Inland Revenue Authority of Singapore) necessary for maintaining compliance with taxes. I will take you through GST filing’s essential parts clearly and data-rich.

The Basics of GST Filing to Know

Before we jump into the application, let us get our basics right. GST (Goods and Services Tax) filing is a mandatory process for businesses registered for GST in Singapore. Think of it as your periodic check-up with IRAS to inform it about the GDP collected and paid by you from your business.

When to File GST

Frequency of filing is determined as per your annual turnover:

- Monthly filing: For businesses whose annual taxable turnover is above $5 million.

- Quarterly filing: For businesses whose annual taxable turnover is below $5 million.

Pro tip: Block your calendar! Deadlines are normally one month after the close of your accounting period.

Also Read : Top 7 Payroll Services and Their Fees in Singapore 2024-25

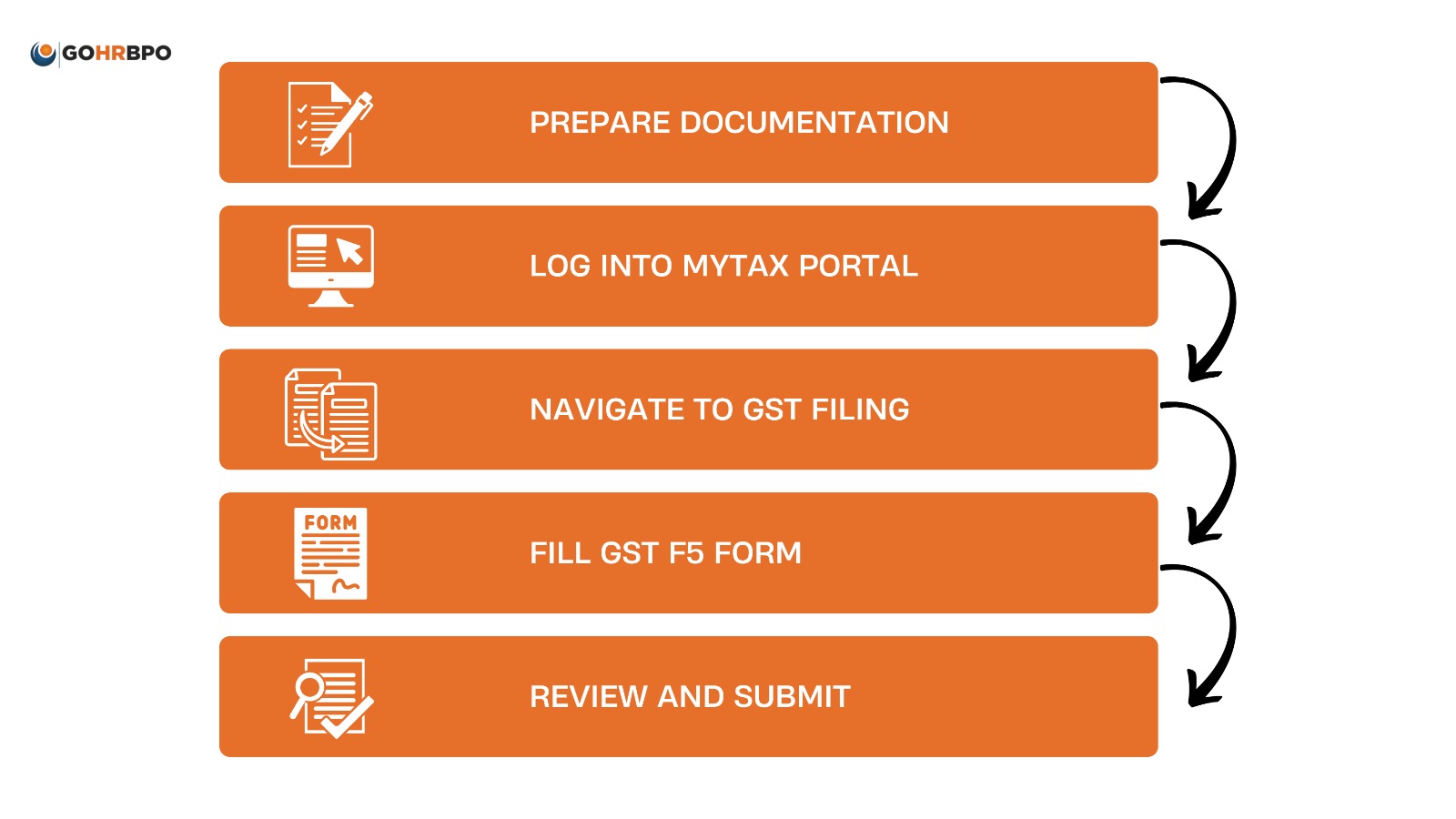

GST Filing IRAS: Step-by-Step Filing Process

1. Prepare Your Documentation

The first thing to do is gather all the documents you need:

- Sales invoices

- Purchase invoices

- Accounting records

- Import and export documents

2. Bank statements

First things first, log Into the myTax Portal

- Here, you should go to IRAS myTax Portal. You will need:

- CorpPass ID and password

- GST registration number

- Your Company’s UEN (Unique Entity Number)

3. Access GST Filing Section

Once logged in-click on:

- GST-select File

- GST Return

- Choose the appropriate accounting period

4. Filling Out Your GST F5 Form

This is what you need to declare:

- Total value of standard-rated supplies (box 1)

- Total value of zero-rated supplies (box 2)

- Total value of exempt supplies (box 3)

- Total value of taxable purchases (box 5)

- Output GST due (box 6)

- Input GST and refund claims made (box 7)

5. Review and File

- Before clicking on the submit button:

- Recheck all figures

- Check for transpositions

- Ensure that the supporting documents correspond with the declared amounts.

GST Filing IRAS: Common Mistakes to Avoid

It is always safe to say; everyone makes mistakes. Therefore, do keep a lookout for the common mistakes:

- Mistake of letting the deadline slip by.

- Mistake of misclassifying supplies.

- Mistake of not keeping proper records.

- Carelessness in reconciling GST accounts.

- Mistake of failing to include exempt supplies.

Tips For A Smoother GST Filing

- Be Organized: File away every document connected to GST properly.

- Use An Accounting Software: Consider a GST-compliant accounting software to automate your calculations and cut down on errors.

- Set Reminders: Set calendar alerts to administer deadlines for filing – trust me, it helps!

- Regular Review: Don’t wait until the very last minute to check. Check your GST accounts once each month.

- Learn: As the IRAS updates its requirements regularly, stay informed through IRAS e-Tax Guides.

After submission:

- An acknowledgment will be issued

- Pay any GST due within the payment deadline

- Keep your records for a period of not lesser than 5 years

Also Read : Best Payroll Service Provider in Singapore: Simplify Payroll with GOHRBPO

Need Help?

IRAS understands GST filing can be complicated. If you face difficulties:

- Call IRAS at 1800-356-8633

- Email gst@iras.gov.sg

- Visit the IRAS GST Division

Final Thoughts

GST filing doesn’t have to be stressful. With proper planning and organization, it can become a smooth part of your business routine. Remember, the key is to stay consistent with your record-keeping and meet those deadlines.

By following this guide and maintaining good GST practices, you’re not just complying with regulations – you’re setting your business up for success. Keep these tips handy, and you’ll find that GST filing becomes more manageable with each submission.