With Singapore still reigning in leadership of digital transformation in Southeast Asia, payroll is witnessing seismic shifts. With an eye blazing on workplace transformation abetted by the Ministry of Manpower, firms are hopeful of causing a paradigm shift in payroll with new technologies and processes to smoothen the problem.

Future Of Payroll: Top Trends in 2025

Artificial Intelligence-Driven Processing

Artificial intelligence is revolutionizing payroll in Singapore. Advanced algorithms tackle complex CPF calculations alongside tax deductions and salary disbursements, now with an unprecedented level of precision. Some companies like DBS and OCBC are already using AI payroll systems that cut down processing time by more than 60%, practically eradicating human error. These systems can predict potential payroll anomalies and flag issues before they actually materialize. This ultimately has reduced a huge burden off administrative processes.

Blockchain Deployment

Blockchain technology is turning out to be a game-changer in effecting payroll security and transparency. Singapore’s financial sector is leading the way, with most of the major banks already applying blockchain to payroll. This technology ensures record-keeping that is immutable and allows for smart contracts that facilitate automatic salary disbursement. For cross-border payments, blockchain has now represented a smoother mechanization for many MNCs in Singapore while in compliance with local laws.

Also Read: What Changes Have Been Made to the Companies Act Recently?

gohrReal-Time Payroll Processing

Traditionally, payroll has been processed on a monthly cycle. However, this is changing to a real-time processing approach. Singapore’s fintech infrastructure allows for salary disbursements to instantly access earnings as they accrue. This trend will benefit the growing gig economy and flexible workplace arrangements. Real-time payroll also improves cash flow for both the employer and employee, lessening their financial stress and enhancing satisfaction at the workplace.

Enhanced Employee Self-Service Portals

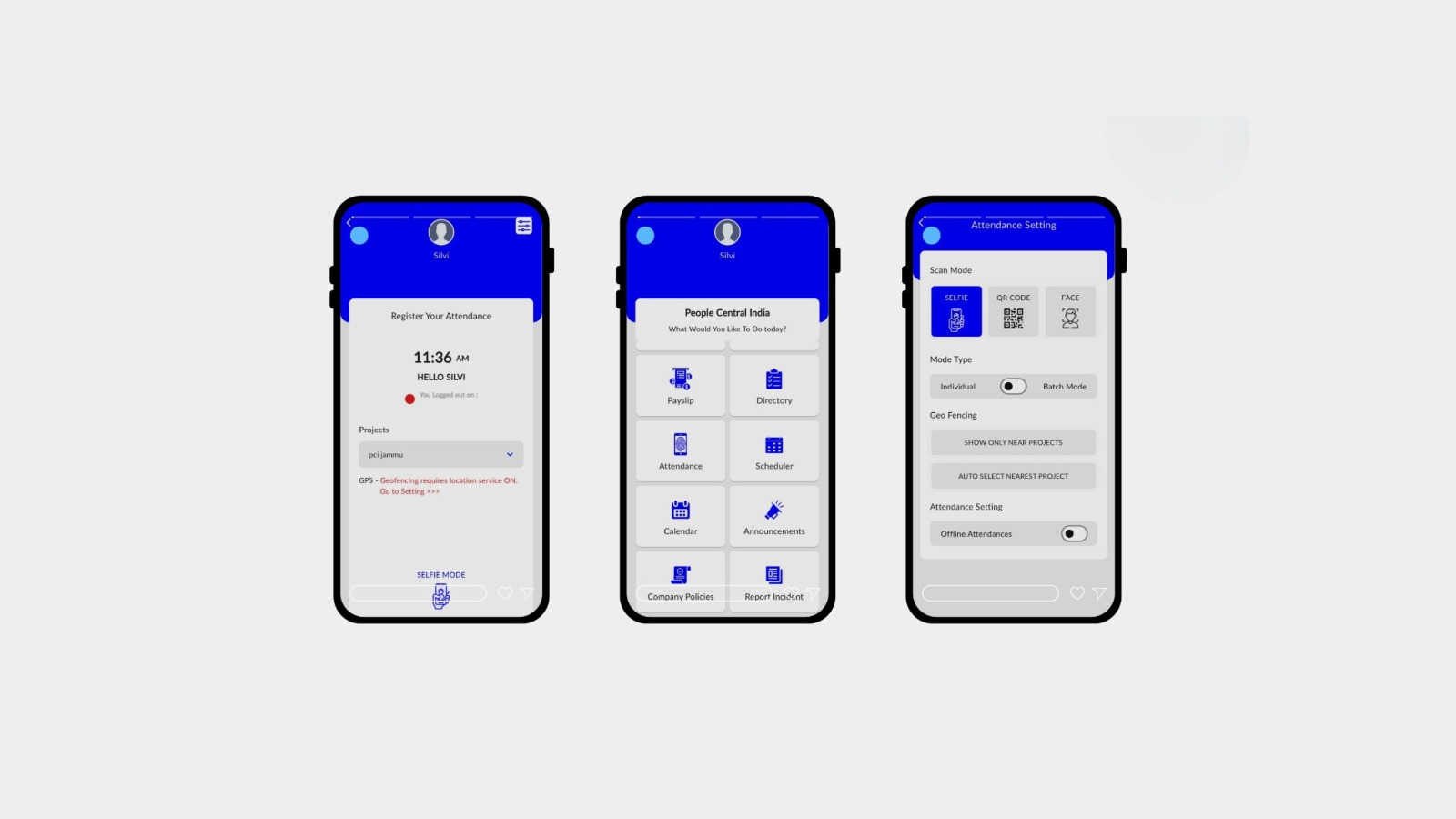

Modern payroll systems now have sophisticated self-service portals linked with SingPass. These platforms enable employees to manage their payroll-related tasks independently-from looking at their payslips to submitting claims. Integration with AI-enabled chatbots has substantially lessened the burden on HR by answering the most frequently asked payroll questions around the clock. Mobile access means Singapore’s tech-savvy workforce can carry out payroll activities on the move.

Predictive Analytics in Payroll Management

Organizations use predictive analytics to skill up payroll budget and workforce planning. These are used to analyze historical payroll data, attendance tendencies, and performance statistics to assess labor cost estimates and surface trends. Besides being quite adaptable in Singapore’s fast-moving business world, it eases the decision-making process around hiring, overtime, and resources. Next-generation analytics also help identify trends concerning employee compensation and benefits utilization, which allows for more strategic planning concerning benefits administration.

Compliance Automation

In the case of Singapore’s stringent regulations related to employment, automated compliance has, therefore, become really essential. The advanced payroll systems are updated continuously in line with the latest regulations set by the MOM, tax policies, and CPF requirements. Such levels of automation reduce compliance risks and ensure immediate compliance with legal propagation, including updates on the Progressive Wage Model. Real-time monitoring of compliance helps businesses avoid improper fines and maintain their standing among Singapore’s business community.

Also Read: The Importance of Accurate Payslip Templates in Singapore: More Than Just a Piece of Paper

Future Outlook

As Singapore moves on, technology integration is creating an efficient, safe, and employee-centric payroll ecosystem. Companies that embrace such innovations will be able to gain a competitive edge brought about by lower costs, increased accuracy, and improved employee satisfaction. The future for payroll in Singapore, thus, will no longer be just a salary survey process-it is about instituting an integrated system that will support business growth and workforce management while ensuring high compliance and security standards.

These advancements in payroll technology align perfectly with Singapore’s Smart Nation initiative, promoting digital transformation across all business aspects. As we progress through 2025, organizations must stay agile and adapt to these evolving trends to maintain their competitive edge in Singapore’s dynamic business landscape. The integration of AI, blockchain, and real-time processing capabilities will continue to reshape the payroll industry, making it more efficient, secure, and responsive to both employer and employee needs.