Singapore’s large corporate payroll services sector is now undergoing an extraordinary metamorphosis fueled by technological innovation, regulatory complexity, and the urgencies of strategic workforce management. An increasingly complex economic environment renders high-end payroll solutions all the more critical in the functioning of businesses.

Evolution of Payroll Services in Singapore

The company landscape in Singapore demands agile and clever payroll services. Large companies no longer see Payroll as an administrative service but as a strategy for operational efficiency and employee satisfaction. The sturdy regulatory framework of the city-state, together with its tech-forward disposition, makes it fertile ground for the growth of modern payroll solutions.

Key Technological Drivers

- AI and Automation – Aimed at modern payroll processes: the reduction of errors in calculations, whilst increasing the rate of work processing. These predictive analytical forecasts show payroll bum-ups even before they occur, saving companies their most scarce resource-a single minute.

- Cloud-Based Payroll Systems – This technology has revolutionized payroll management. Real-time access, greater security, and integration with other HR systems form the cloud combination with payroll, which allows companies an unprecedented ease and exactness in managing their global workforce.

- Compliance and Risk Management – For Singapore’s stringent labor laws and IRAS tax regulations, payroll services must be far more than devices to do the actual computing; instead, they enable managers to look at all areas of employment. These now encompass a comprehensive compliance platform, ensuring that a company can remain aligned with changes in any new legislation.

Also Read : Best Payroll Outsourcing Services for Small Businesses in Singapore

Payroll Services For Large Companies: GOHRBPO (A Game-Changing Payroll Solution)

When it comes to providing efficient payroll management for big organizations, GOHRBPO emerges as a great choice. Their payroll services are intended to address the sophisticated requirements of the contemporary business:

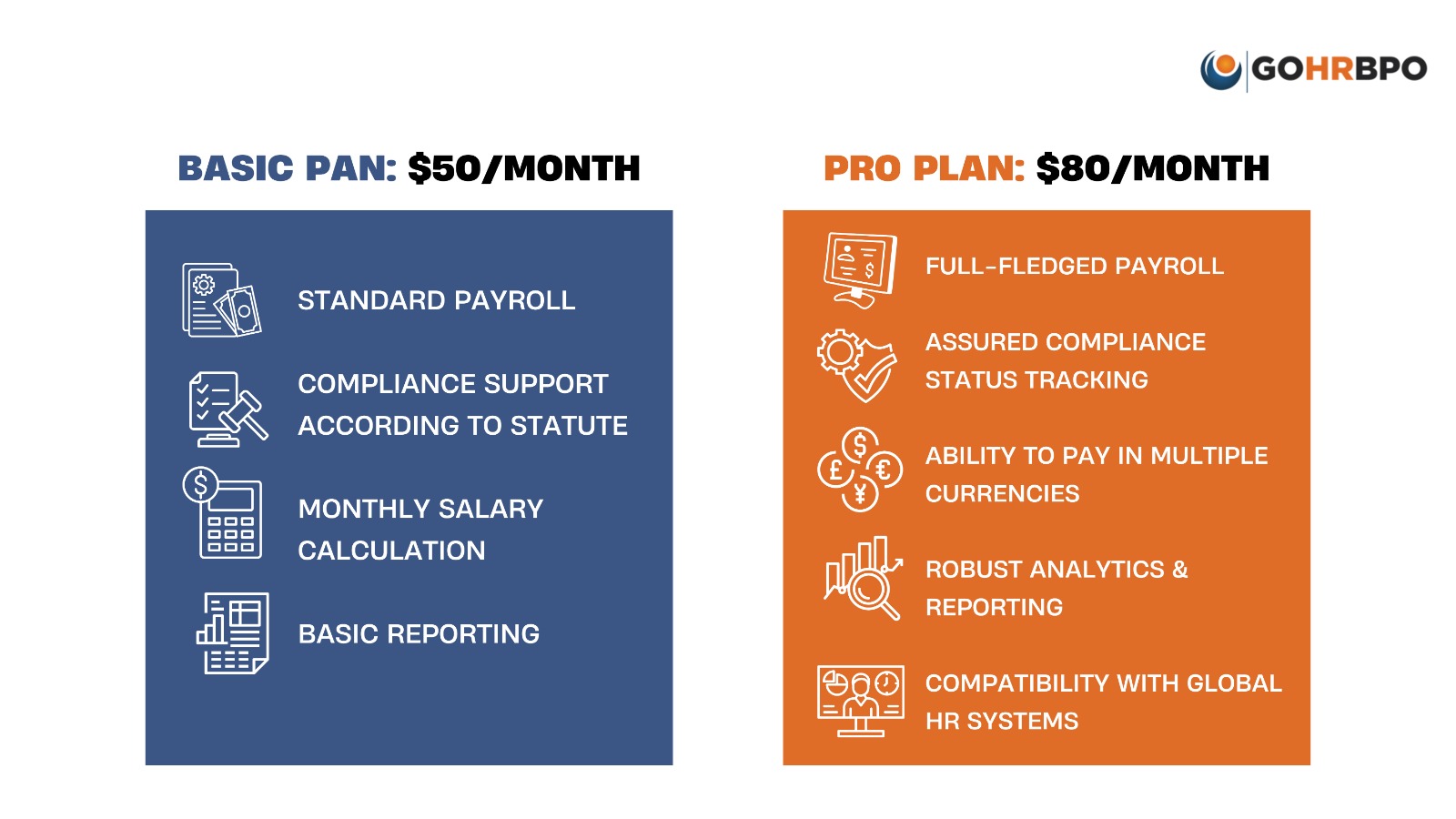

Pricing Packages

Basic Pan: $50/month

- Standard payroll

- Compliance support according to statute

- Monthly salary calculation

- Basic Reporting

Pro Plan: $80/month

- Full-fledged payroll

- Assured compliance status tracking

- Ability to pay in multiple currencies

- Robust analytics & reporting

- Compatibility with global HR systems

Reasons to Outsource Payroll

- Cost Savings: The outsourcing process cut down on cost due to the elimination of a costly in-house payroll operation.

- Expert Handling of Compliance: Professional payroll services enable stringent employer compliance with Singapore’s complex regulations, thus minimizing the risk of an employer being legally charged.

- Improved Data Security: Specialized providers implement extreme security methods to safeguard the sensitive financial information of employees.

Also Read : How Payroll Outsourcing Services Reduce Costs for Companies in Singapore

Future Trends in Payroll Services

Predictive Analytics

Future payroll services will make further use of analytics to give strategic insights into workforce management, compensation trends, and in all aspects of financial planning.\

Blockchain and Cryptocurrency Integrations

These new emerging technologies will also permit more dynamic, safer, and instantaneous payroll transactions.

Personalized Employee Financial Wellness

The advanced payroll platforms will offer customized financial advice aligned with individual employee requests, thus allowing for a better management of their compensation and benefits.

Conclusion

The workflow of payroll services in large firms in Singapore is not restricted to mere processing of salaries; it entails an attribution of wisdom to have a compliant and strategic ecosystem of workforce management.