In a dynamic, competitive, and fast-changing business environment such as Singapore, compliance with regulations becomes more than a mere legal obligation; it becomes a strategic imperative for sustainable organizational success. In one of the most sophisticated business environments in the world, Singapore requires strict adherence to complex regulatory frameworks.

The Landscape of Regulatory Compliance in Singapore

The Monetary Authority of Singapore (MAS) defines regulatory compliance as a multi-faceted approach for achieving the highest compliance with applicable law and ethical standards across all business operations. For businesses operating in Singapore, this involves complying with numerous, often overlapping, regulatory demands-James.

Regulatory Compliance Frameworks

1. Financial Services Regulations

These are the regulations that govern the financial services in Singapore.

- Anti-money laundering guidelines

- Know Your Customer protocols

- Check the standards for financial reports

- Cybersecurity requirement

2. Corporate governance requirement

The Accounting and Corporate Regulatory Authority is pretty big on:

- Transparent financial reporting

- Board accountability

- Standards of ethical practice

- Strong internal control systems.

Also Read : How Payroll Outsourcing Services Reduce Costs for Companies in Singapore

Regulatory Compliance Challenges in Singapore

1. Technological Disruption

Modern regulatory compliance confronts:

- The startling pace of technological change,

- Integration of complex digital ecosystems

- Dawn of new and complex cyber-security threats,

- Diversity of regulatory regimes across borders.

2. Multinational Complexity

Organizations conducting business across borders must:

- Understand local regulatory nuances

- Devise flexible compliance solutions,

- Conform to standards of ethics that are constant through all jurisdictions,

- Meet cross-jurisdictional requirements.

Best Compliance Practices

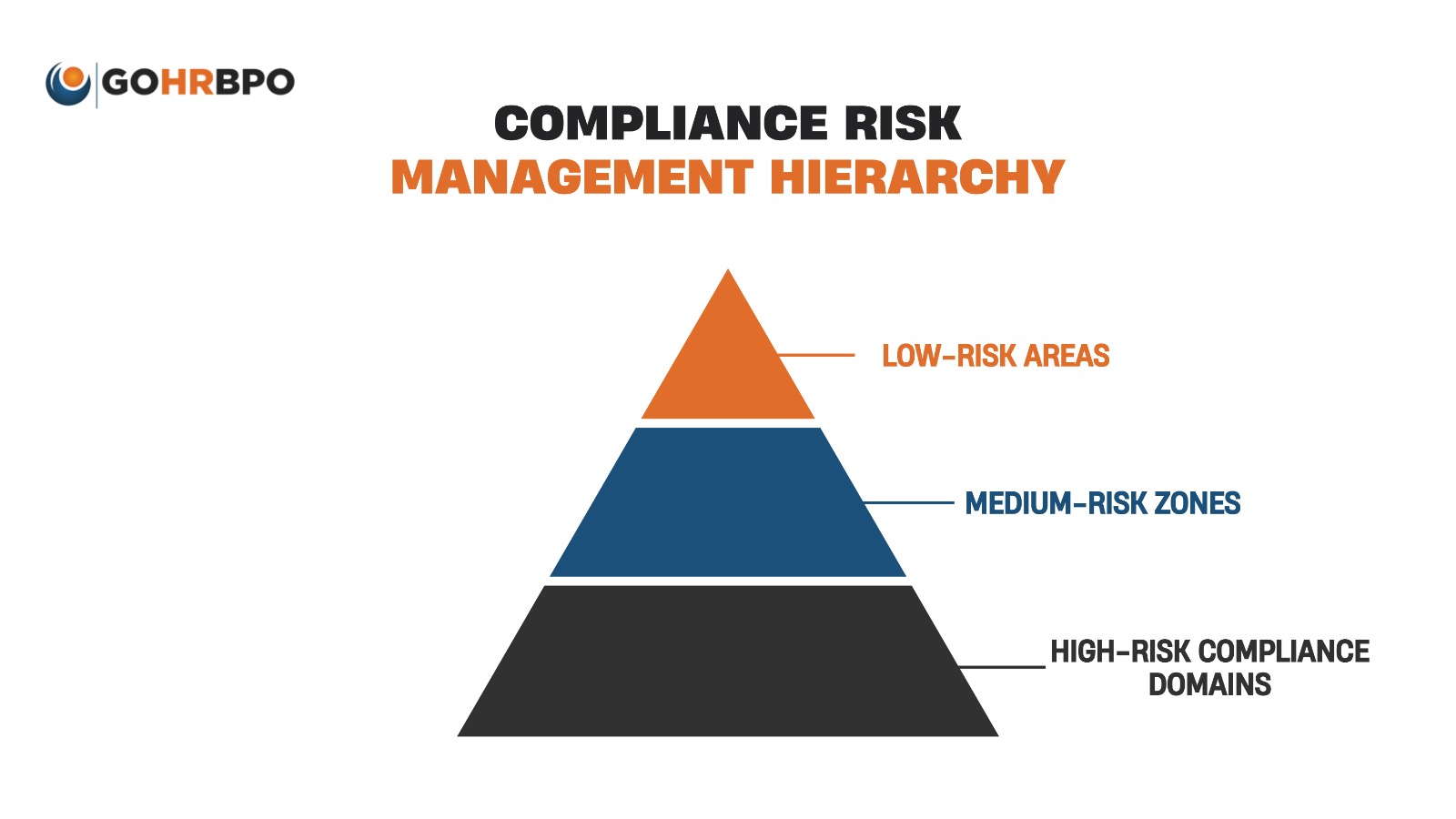

1. Risk Management Proactiveness

Some suggestions from the Singapore Business Federation include regular assessments of risks such as:

- Complete compliance audits,

- Continuous employee training,

- An adaptive compliance framework.

2. Technology Integration

State-of-the-art compliance strategies harness advanced analytics such as:

- AI-powered monitoring systems,

- Automated reporting tools,

- Real-time compliance dashboards.

Handling Compliance Implementation Strategies

- Development of Robust Frameworks

The successful ones identified:

- Clear policy articulation

- Transparent reporting mechanisms

- Regular internal checks

- Consultation with some external experts

- Cultural Embedding

Effective compliance necessitates:

- The commitment of leadership

- Organizational culture accordant with processes

- Training in ethical decision-making

- Multi-leveled accountability

Consequences Of Non-Compliance

Potential Risks

There are many problems faced by organizations, such as:

- Huge monetary fines

- Complexities in reputation

- Disturbances in daily operations

- Legal proceedings

Also Read : Top Payroll Software Company in Singapore | GOHRBPO

Future Of Regulatory Compliance

Expected Developments

Industry experts foresee:

- Digital integration

- More complex monitoring systems

- Cooperation between industries

- Increased international harmonization

Conclusion

Regulatory compliance in Singapore is dynamically multidimensional, which points towards continual learning and constant embrace of change, amongst others. Why do businesses care about compliance as a snake pit? Because corporate success in Singapore necessitates welter in business acumen—combining technology with a cultural commitment, risk management, and much more.

Success requires a holistic approach: the fusion of technological innovation, cultural commitment, and proactive risk management. When organizations really invest in integrated compliance strategies, they can attain an enviable competitive advantage from the claws of the regulatory requirements.