The Singaporean environment is dynamic within which SMEs compete for different ways to run their enterprises smoothly and minimize the administrative workload on themselves. Payroll management is one area of great outsourcing advantages for increased operational efficiency, compliance with the law, and ease of mind.

Transforming the Payroll Landscape in 2025

Singapore’s payroll outsourcing industry is set to undergo transformation in 2025, giving way to complex reviews and previews. It is a fast area growing- which actually, until quite recently, was a monotonous and humdrum task. Today it still demands:

- Managing Complex tax laws

- Maximizing contributions at the Central Provident Fund

- Handling of work pass compliance

- Meeting increased digital reporting requirements

For SMEs, navigating these complexities can be overwhelming. This is where the right payroll outsourcing vendor becomes crucial.

Also Read : Top 7 Payroll Services and Their Fees in Singapore 2024-25

Payroll Outsourcing Vendor Singapore: Key Considerations When Choosing One

1. Knowledge of Regulatory Compliance

The strict regulatory environment in Singapore requires an ideal vendor to show extensive knowledge in various fields, including:

- In-depth understanding of Singapore’s Employment Act

- Renewed knowledge of the CPF regulations

- The ability to comply with payroll intricacies regarding Work Pass (EP, S Pass, Work Permit)

- Remains in good consideration with IRAS.

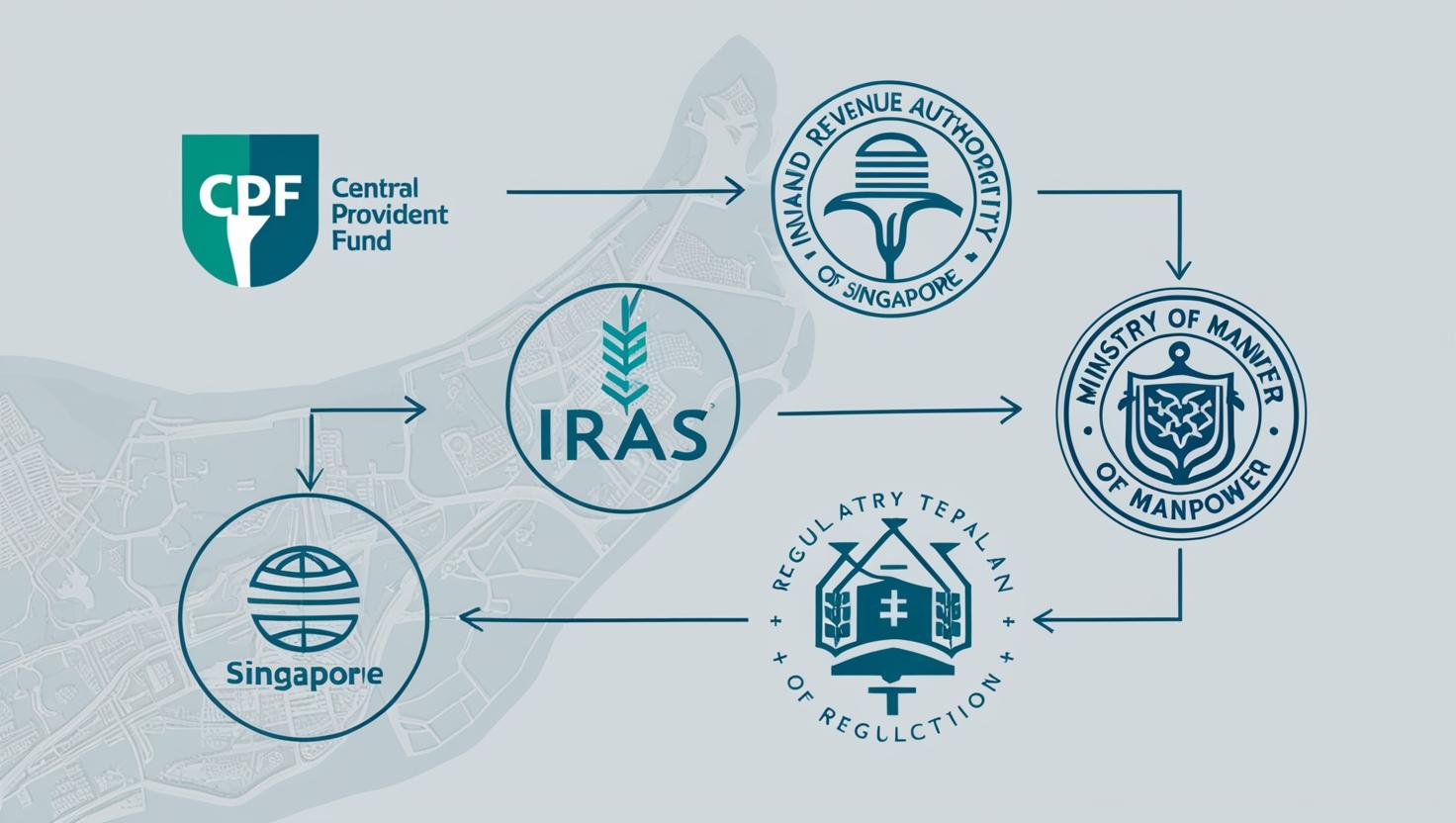

Regulatory Landscape Diagram: A flowchart-style image depicting:

- Central Provident Fund (CPF) logo

- IRAS logo

- Ministry of Manpower emblem

- Connecting arrows showing regulatory interactions

- Stylized Singapore map in the background

2. Technology-Savvy And Security-Conscious

In 2025, it won’t be simply about payroll computations, but also about secure and smart systems; look for vendors that can provide you with:

- Cloud-based platforms with bank-grade encryption protection

- Multi-factor authentication

- Real-time reporting

- Integration capabilities with existing human resource management systems.

3. Scalability And Flexibility

Your payroll solution should grow with your business. Scalability features that are very important include:

- Flexible pricing models

- Quick and easy addition or removal of employees

- Easy customization of reporting to suit business needs

- Support for multiple methods of payment.

4. Cost-Efficiency

SMEs are always found in a fix about money. This is where GOHRBPO shines, with its pricing model in 2025 being incredibly competitive:

Basic plan: $50 a month

- This includes basic payroll processing

- Caters to small teams

- Is inclusive of submissions of statutory reports done monthly.

Pro plan: $80 a month

- Comprehensive management of payroll

- Advanced reports

- Additional compliance support

- Best suited for growing SMEs.

Also Read : The Importance of Accurate Payslip Templates in Singapore: More Than Just a Piece of Paper

Why GOHRBPO Stands Out in 2025

In Singapore, GOHRBPO has established itself as a premier provider of payroll outsourcing by:

- Affordable pricing that is straightforward and valuable

- Supplying localized knowledge of the complicated payroll landscape in Singapore

- Setting up effective technological solutions

- Guaranteeing compliance and security from start to finish.

Real World Benefits for SMEs

Partnering with a specialist vendor like GOHRBPO is a way for an SME to:

- Minimize administrative load

- Avoid compliance tussles

- Learn from practitioners

- Concentrate on growth in their core business.

- Improve overall operational efficiency

Making the Right Choice

When selecting a payroll outsourcing vendor, remember:

- Request detailed demonstrations

- Check client testimonials

- Understand the full scope of services

- Evaluate technological capabilities

- Consider long-term scalability

Conclusion

In 2025, payroll outsourcing is no longer a luxury but a strategic necessity for Singapore’s SMEs. By carefully selecting the right vendor, you can transform payroll from a complex challenge into a streamlined, efficient process.