Introduction

If you’re someone who is running a company, then you know handling payroll is not an easy task. If we talk about a country like Singapore, then it is far from straightforward.

It is not just about paying the staff, here are, you also have to navigate rules around CPF, IRS submissions, and a long list of compliance checks.

Even if you unknowingly make a mistake, the whole process can turn into penalties and hours of corrective work.

I think for smaller companies where both time and money are stretched, these errors will divert away from growing the business.

That is why I suggest handing it over to specialists. This means outsourcing the payroll. It brings accuracy, keeps everything compliant, reduces costs, and gives business owners one less critical task to worry about.

The Payroll Problem for Singapore SMEs

Payroll is not as easy as just “calculate and pay.” There is actually a lot that you have to deal with:

- Compliance Stress: There is a lot of stress every month regarding CPF contributions, IRS filings, and MOM payslip rules. If by any mistake, you miss one, it means legal trouble and penalties.

- Time Sink: On average, SMEs spend more than six hours a month handling just payroll. I think that is a lot of time that can be used and spent somewhere else better.

- Disconnected Systems: HR, leave, payslips, and payroll often sit in separate tools. This makes the whole HR process disconnected, which leads to duplication and mistakes.

- Penalty Risks: There is always a penalty risk if you make any mistake while dealing with the payroll. For example, if CPF payments are late, then you are going to deal with 1.5% monthly interest plus fines that can go up to $10,000.

Also Read: A Step-by-Step Guide to Managing Startup Payroll Services 2025

Did you know? Nearly 50% of employees consider leaving after two payroll mistakes. That makes total sense because I think accuracy matters for retention.

Why Outsourcing is the Smarter Choice

When you outsource payroll, you get peace of mind on compliance and a lot more breathing room operationally. Here is why it is the smarter choice:

- Compliance Assurance: With outsourcing, you have specialists who are totally aware of CPF, IRAS, and MOM updates. They are the ones who take care of all of these things, and you don’t have to be worried about missing a deadline.

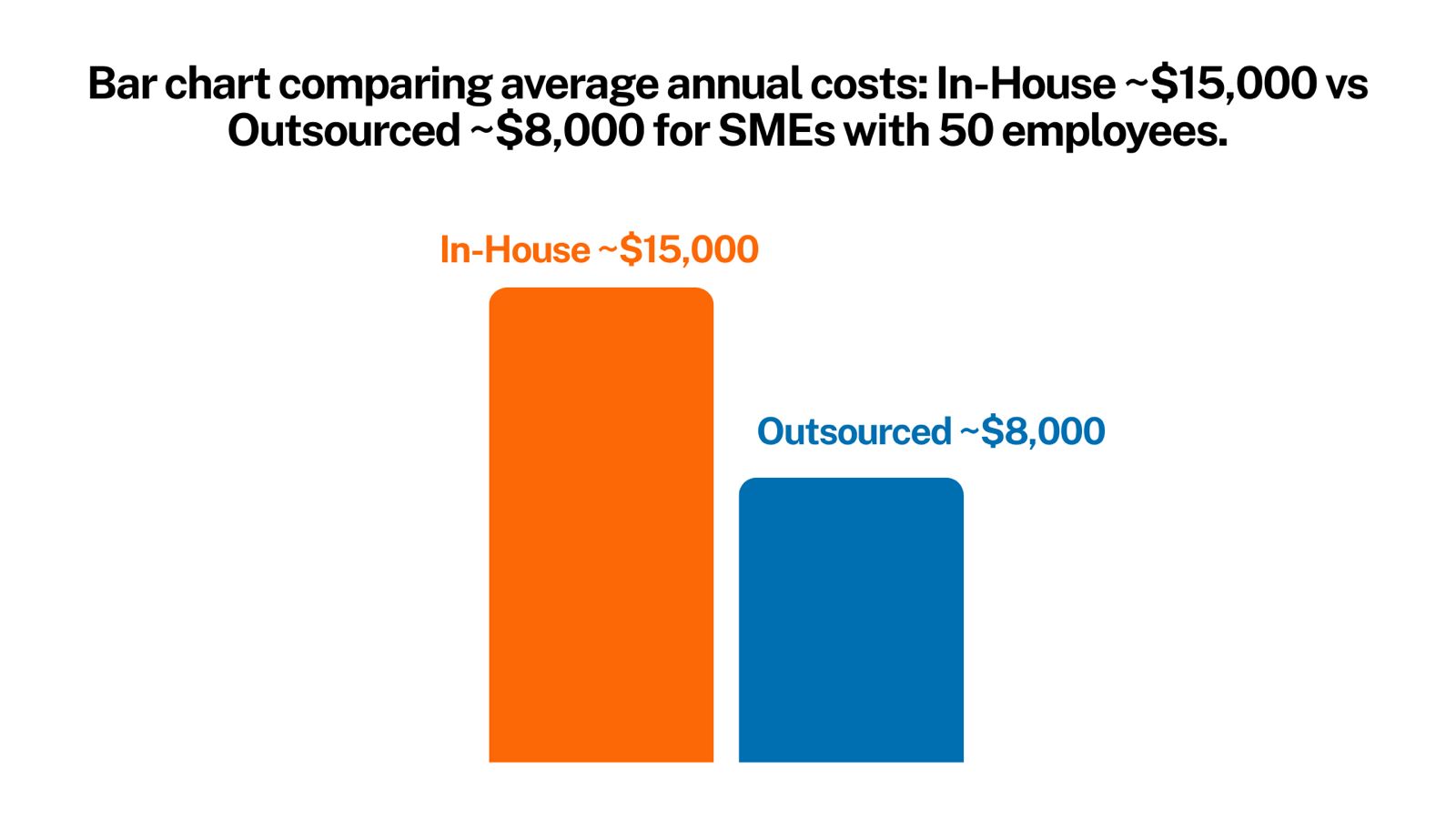

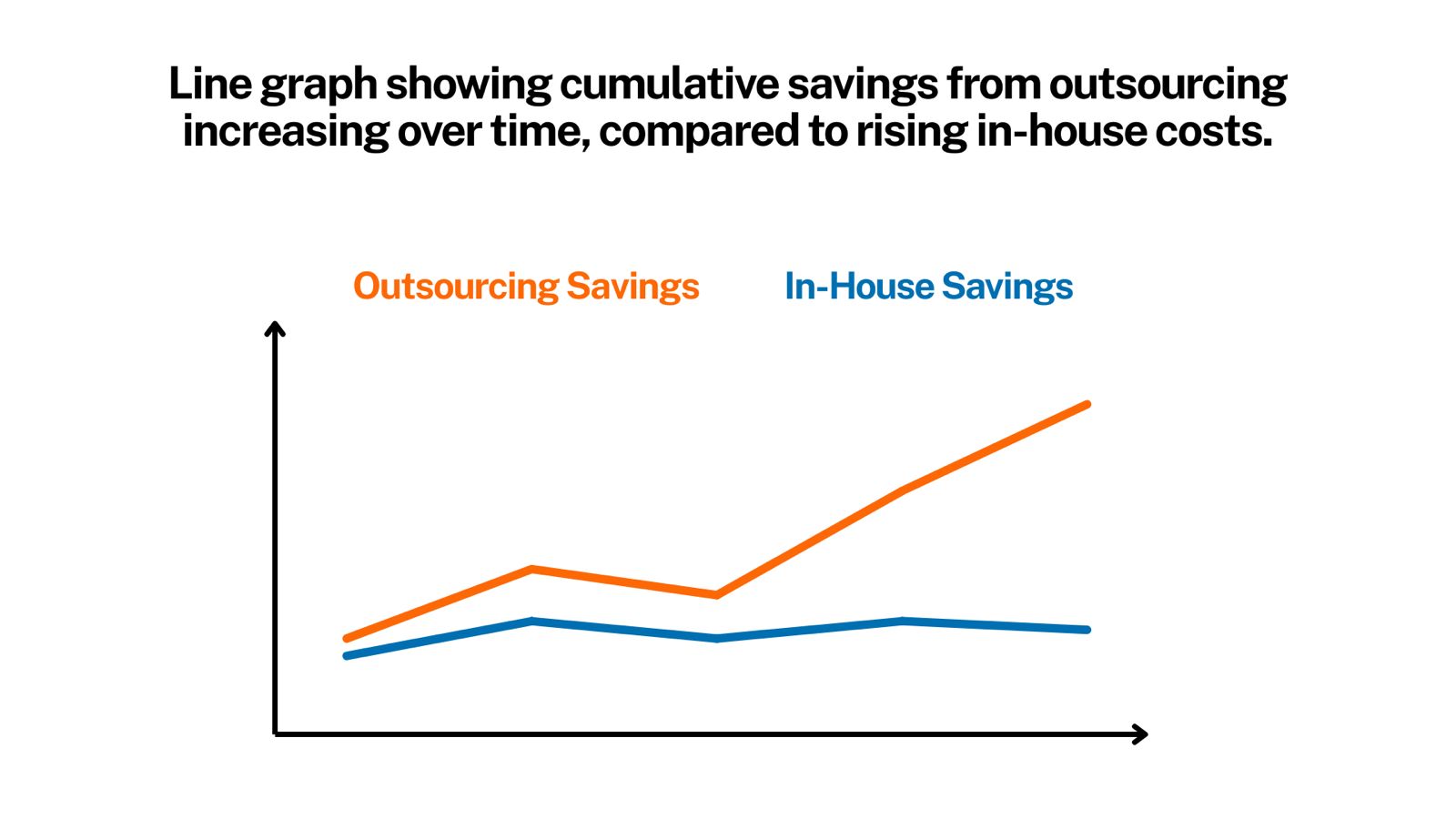

- Time and Cost Savings: When you are outsourcing, you don’t have to calculate anything or pay extra for any payroll software. This will save you time and money.

- Error-Free Accuracy: With automation and AI doing the main work, the errors that show up due to manual work don’t happen.

- Data Security: the systems are ISO27001 certified and PDPA compliant. This means sensitive employee data stays protected.

- Better Employee Experience: Your employees get to have a better experience. With a self-service portal, they can download payslips and check leave balances anytime without having to ask HR for the same.

Cost Savings at a Glance

| Aspect | In-House Payroll | Outsourced Payroll |

| Staffing Costs | HR payroll staff + training | None (service fee only) |

| Software | $3,000–$5,000 annually | Included in service |

| Compliance Risk | High (penalties, fines) | Low (expert handling) |

| Time Spent | 6–8 hours per month | 1 hour to review reports |

In-House vs Outsourcing: Which Makes More Sense?

| Factor | In-House | Outsourced |

| Cost | High (staff, software, audits) | Flexible per-head pricing |

| Time | 6+ hrs/month | ~1 hr/month |

| Risk of Errors | High | Low (expert compliance) |

| Scalability | Hard (hire more staff) | Easy (pay per employee) |

How to Use the Right Provider

If you are choosing a payroll partner in Singapore, here are a few things you should check for:

- Local Expertise: The platform you choose for outsourcing should know the CPF, IRS, and MOM requirements thoroughly.

- System Integration: Payroll should connect smoothly with HR and leave management, and the whole system should be integrated.

- Scalability: As your team grows, you should be able to add new employees or new services to the platform with ease.

- Data Security: The platform you are choosing should be ISO certified and should have PDPA compliance so that your data stays safe.

- Support: It should have a Singapore-based help desk to help you whenever you need.

Also Read: AI Chatbot Trends: What’s Next for Intelligent Conversations?

Conclusion

Payroll is something that should run smoothly for you in the background. When you outsource it, you’re not only saving time and money, but you’re also staying compliant with all CPF, IRAS, and MOM rules.

According to me, the best part is that your team gets to focus on the actual work of growing the business, instead of dealing with payslips and deadlines.

That is why I always say if payroll feels like a burden, it is time you switch to outsourcing. You will be surprised to see the amount of peace. It brings to you and how many hours it gives back to your day.