Filing income tax in Singapore does not have to be a nightmarish experience. As we move towards the 2024 tax season, I shall take you through everything you need to know about the filing of your returns for Year of Assessment (YA) 2024, covering income earned in the year 2023.

Important Dates To Remember

To start with, block it out on your calendar! For YA 2024, the income tax filing period is normally 1 March to 18 April 2024. Do note that failure to comply with the deadlines for filing returns would normally attract penalties, so it’s better to get them done early than to scramble in the last moments.

Also Read : Tips for Accurately Filling Out the 2024 IR8A Form

Before You Begin: Getting Organized

Before diving into the filing process, gather these essential documents:

- Your SingPass login credentials

- Employment income records (IR8A form)

- Investment income statements

- Rental income documentation (if applicable)

- Receipts for tax-deductible donations

- Insurance premium statements

- Course fee receipts for approved courses

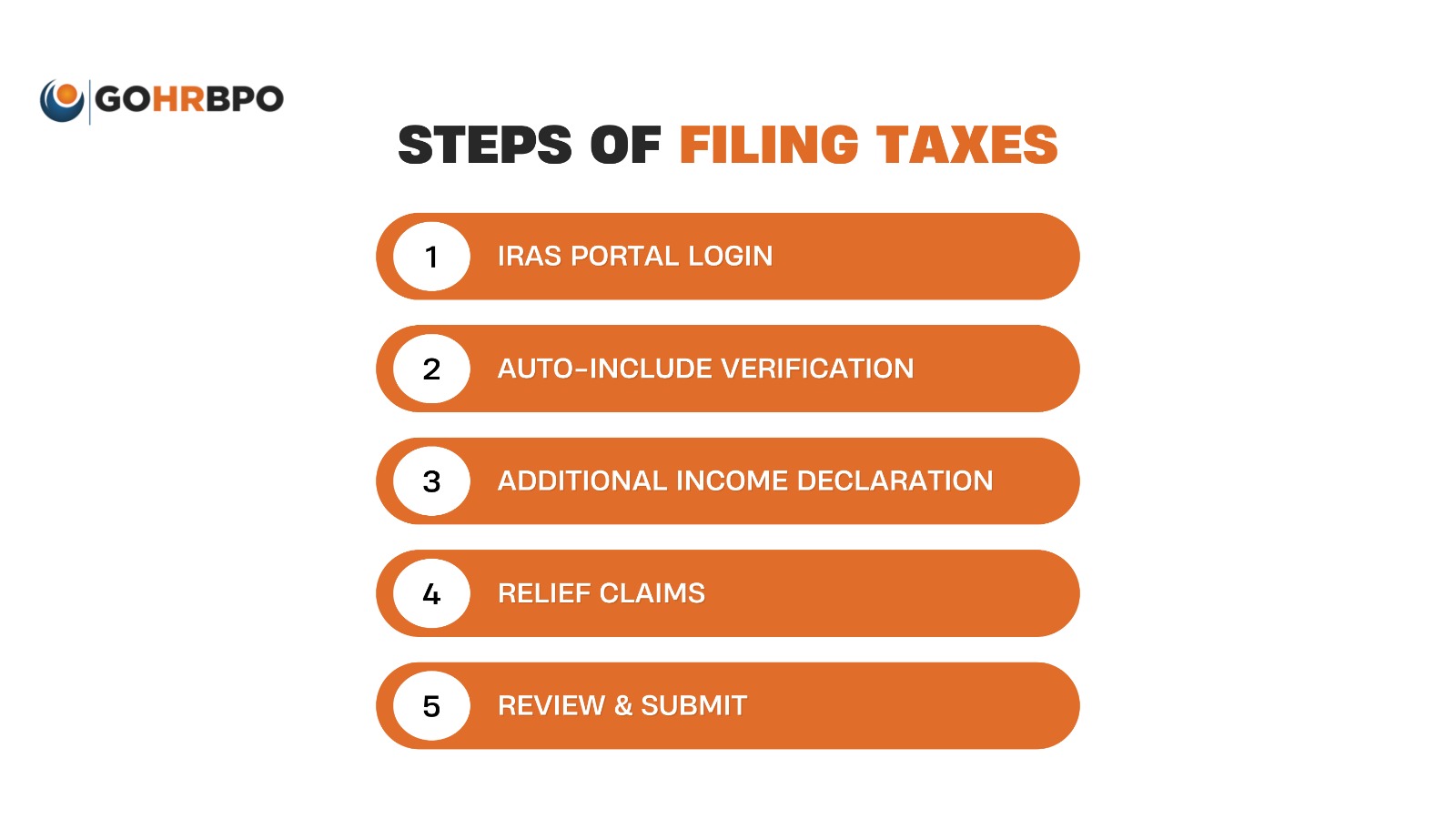

Income Tax Singapore: Step-by-Step Filing Process

1. Log into the IRAS Portal

Go to the IRAS website and sign in with your SingPass. All things relating to tax will be handled via the myTax Portal.

2. Validate Your Auto-Inclusion Information

IRAS has made the work easier with the Auto-Inclusion Scheme (AIS). Verify that the details of your employment income, approved donations, and other pertinent information have been added. Do confirm that every piece is right, not just take it for granted.

3. Declare Additional Income

- Make sure that you declare any additional income:

- Freelance or self-employed income

- Rental income derived from properties

- Any amount of foreign-sourced income that would be brought into Singapore

- Investment gains where applicable

4. Claim Your Tax Relief and Deductions

A wide range of tax reliefs and deductions aims to reduce your chargeable income. Generally, they include:

- Earned Income Relief

- Parent Relief

- Working Mother’s Child Relief

- Course Fee Relief

- CPF Relief

- NSman Relief

- Spouse/Handicapped Spouse Relief

5. Review and Submit

Before you press “submit”:

- Double-check your amount

- Ensure that you have claimed all the reliefs due to you

- Check your personal particulars

- Make sure you keep a record of your tax return.

Income Tax Singapore: New Changes for YA 2024

This year, several updates to Singapore’s tax system include:

- Revised Working Mother’s Child Relief (WMCR) – It will now be percentage-based instead of fixed amounts.

- Revamped Earned Income Relief for seniors.

- Updated Personal Income Tax Relief Cap, which remains at $80,000.

Smart Tips for Filing

- Good Record Keeping: means having a folder (digital or hard copy) for all tax-related documents throughout the year.

- Use Tax Calculators: IRAS has made available a number of calculators, available online, that allow you to estimate your tax liability; make use of them to remain in the clear.

- Planned Deductions: There are some deductions, such as charitable donations, that can be more effectively timed.

- Choose a GIRO Payment: Should your tax bill be in a rather hefty amount, you may want to consider paying through GIRO in 12 equal payments with interest-free installments!

Also Read : What Are the Different Types of IRAS in Singapore?

When you Submit Your Returns?

After submission, IRAS will process your return and issue a Notice of Assessment (NOA) indicating the final tax payable amount. Please take care to review this document upon receipt.

Final remarks

Filing your income tax in Singapore tends to be fairly easy once you understand the procedures involved. Organize your schedule through the year and then claim whatever reliefs are available to you. When in doubt, consult with the IRAS official resources or other experts.

Note: Tax laws and regulations can change. Always verify current information with IRAS.