Picture this: It’s the 13th of the month, and you’re racing against time to submit your employees’ CPF contributions. Sound familiar? You’re not alone. As someone who has worked with numerous Singapore businesses, I’ve seen firsthand how CPF submissions can become a source of stress for many employers. But it doesn’t have to be this way.

Whether you’re a new business owner or a seasoned HR professional, managing CPF contributions accurately is a crucial responsibility that impacts your employees’ financial future. In this guide, I’ll share practical insights and proven strategies to help you master your CPF submission process, ensuring both compliance and peace of mind.

Basic Understanding of CPF Contributions

Before we get into the nitty-gritty of the debacle, please know that CPF contributions must be contributed for all Singapore Citizens and Permanent Residents who earn over $50 a month. By the rules of the CPF Board, the employer is expected to finance both the normal employer-contribution and the employee-contribution by the end of every month.

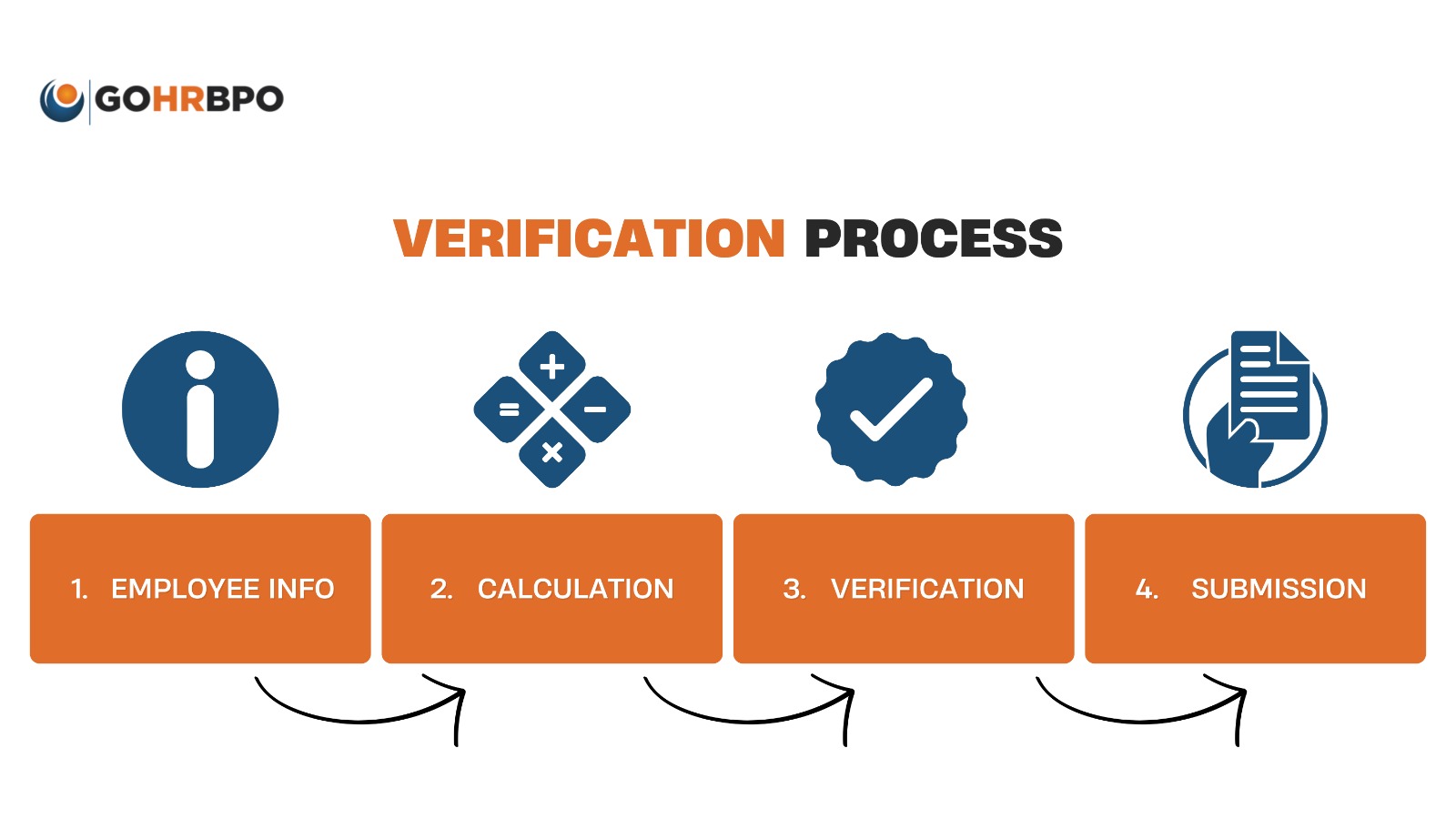

CPF Submission Employer: Key Steps for Accurate Submissions

1. Verify Employee Information Regularly

Start with the basics:

- Ensure all employee details are updated

- Double-check NRIC numbers

- Verify employment start and end dates

- Confirm leave or salary information is updated

2. Calculate Contributions Correctly

Don’t forget, the accuracy of your calculations is said to be sacred.

- Integrate the latest CPF contribution rates

- Remember the age groups and wage ceilings

- Include all other wage components

- Compensate for any salary adjustments

3. Determine Appropriate Checks

A multi-level verification process may be established:

- Initially, calculation by the payroll staff

- Follow-up review by a supervisor

- Last-style check before it gets out

- Audits carried out regularly on earlier submissions.

Also Read : How to Calculate Salary from CPF Contribution: A Singaporean’s Guide

CPF Submission Employer: Common Mistakes to Avoid

Late Submission

All remittances of CPF contributions have to be made before the due date to avoid late payment penalties. The last date will be the 14th of the following month.

Incorrect Contribution Rates

Different age groups require different contribution rates. Always look out for the latest CPF contribution rate tables and the wage ceilings.

Overlooking Additional Wage Components

Do not forget to include:

- Bonuses

- Overtime Pay

- Commissions

- Allowances

Best Practices for CPF Submission

1. Digital Tools

- Using technology for reduction of errors:

- The CPF e-submission platform;

- Payroll software with CPF calculation features;

- Regular updates always to reflect the latest rates.

2. Record Keeping

Everything must be documented:

- Payment records;

- Calculation sheets;

- Employee particulars;

- Contribution history.

3. Being Updated More on Changes Concerning the CPF

CPF policies and rates change regularly. Subscribing to CPF Board updates is highly recommended, in addition to attending employer briefings whenever available.

What to Do When Mistakes Happen?

Mistakes tend to happen even despite one’s best efforts. Thus, this is what to do:

- Report the error to CPF Board immediately

- Prepare excellent documentation

- Make adjustment payments immediately

- Check processes to prevent recurrences

Training Your Team

Invest in building the knowledge of your payroll team:

- Regular training sessions

- Access to CPF resources

- Well spelled-out standard operating procedures

- Regular policy changes updates

Also Read : Affordable Payroll Management Services for Startups: Empowering Singapore’s Entrepreneurial Spirit

Establishment of a calendar system

Create a CPF submission calendar that:

- Marks submission deadlines

- Schedules internal reviews

- Plans for quarterly audits

- Sets reminders for rate changes

Let GOHRBPO Take Care of Your CPF Submissions

Struggling with CPF submissions? Why handle this complex responsibility alone when GOHRBPO can ensure accuracy and timeliness for you? Our dedicated team of payroll experts specializes in Singapore CPF regulations and can:

✓ Handle your monthly CPF calculations with precision

✓ Ensure compliance with the latest CPF policies and rates

✓ Submit contributions well before deadlines

✓ Manage all CPF-related documentation

✓ Handle any adjustments or corrections promptly

✓ Provide regular reports and updates