We’ve all been there-your work-related purchase was made from your pocket, and now you’re getting that money back. It doesn’t matter if you’re a rookie getting started with your first job or if you’re a well-seasoned employee; the whole reimbursement claiming process in Singapore is something like a jigsaw puzzle. Relax! I’ll guide you through everything that you need to know to make your claim with confidence and ease.

Understanding Reimbursement Claims in Singapore

Before getting right into the process, it is wise to find out the type of expenses which can be made claimable. Common reimbursable expenses in Singapore include travel-related costs, medical costs, training expenses, etc., as well as purchases on behalf of employers. Employers, according to the Ministry of Manpower (MOM), must have a clear policy on what expenses are reimbursable and how an employee is to make a claim.

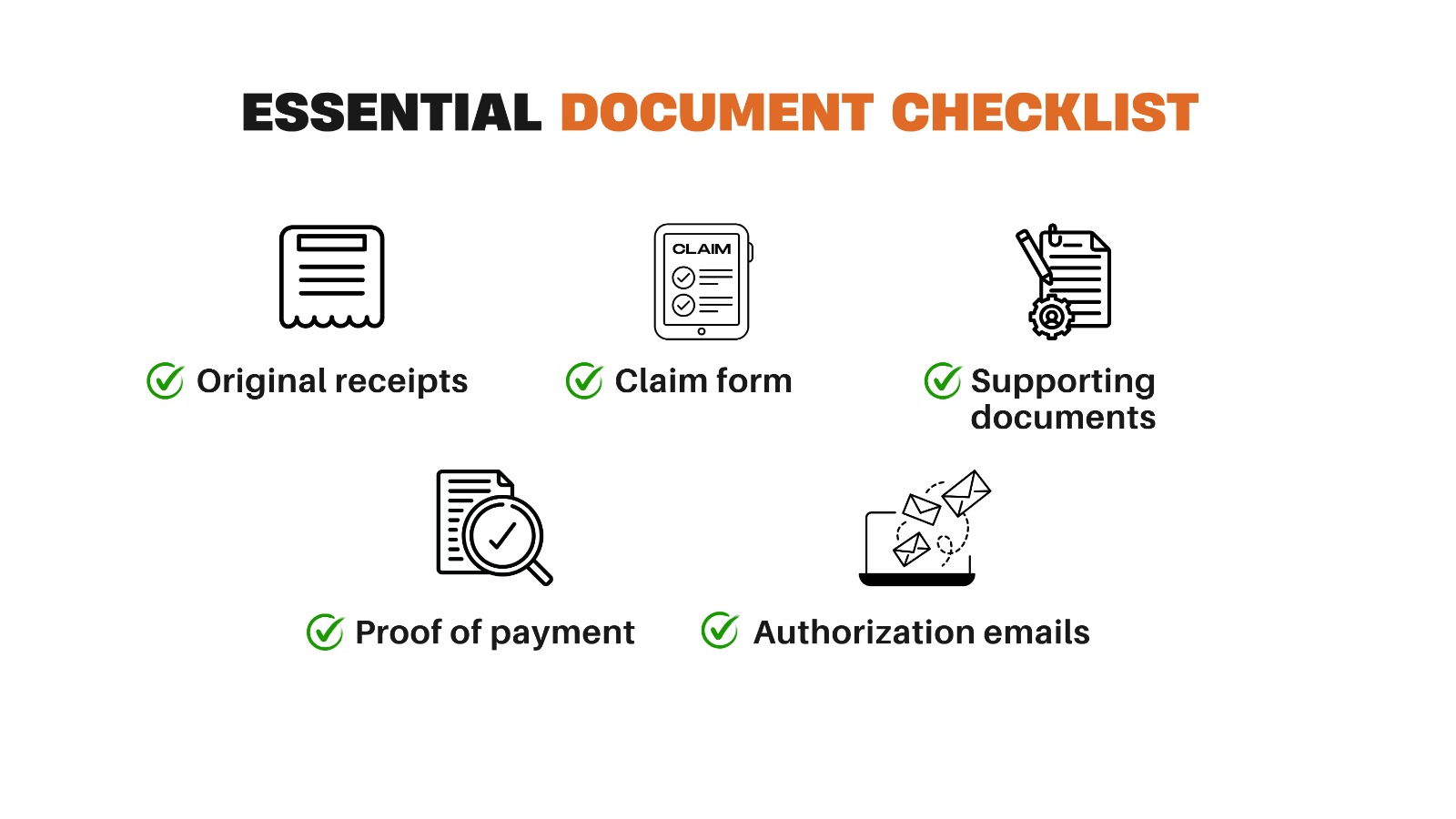

Essential Documents

All right, gather these absolutely essential items for your reimbursement application to kick off:

- Original receipts (no photocopies unless otherwise specified)

- Completed claim form provided by your organization

- Appraisal documents (event invitation, proof of course completion, etc.)

- Proof of payment (usually in the form of credit card statements or bank transfers)

- Allowance emails (if this is a company norm or requirement)

Step-by-step: Submission Guide

1. Check your applicable company policy

Every organization has its own reimbursement policy on issues of submission deadlines, eligible expenses, maximum claimable amounts, and documents required in Singapore.

2. All receipts should be in order

Develop a system under which to keep up with expenditures when they happen. Expense tracking apps or a simple spreadsheet can be employed. Keep all records of expenditure mentioned by the IRAS for a period of five years.

3. Fill in the claim form

Complete all specified fields in your company’s claim form. Make sure you take care of:

- The expense categories

- The GST amounts (if applicable)

- Purpose of the expenditure

- The project codes or cost centers

4. Follow The Right Channel To Submit

Most Singaporean companies are nowadays submitting claims online. It may be via a human resource system or expense management software:

- Scan or photograph your receipts clearly.

- All supporting documents are uploaded.

- Verify all attachments twice.

- Secure your submission’s reference number.

5. Track Your Claim

After submission, make sure to follow up actively:

- Note time expected for processing.

- Keep a record of your claim reference number.

- Make a swim if the deadlines have not been met.

- Respond to anyone regarding any clarifications raised promptly.

Also Read: Gohrpo Payroll Outsourcing Price for Premium Company with Features

Top Tips for Successful Claims

Nudge Receivables with Clear Approvals

When you can, get pre-approval on larger expenses. This will both minimize the chances of rejection and get your reimbursements to you faster.

Keep Clear Records

Keep immediate digital copies of all purchase receipts because of the humidity levels that do not do paper receipts any good. Backups really do matter.

Submit Soon

Don’t let it fester to the last minute. Most of the companies in Singapore have monthly cut-off dates for claim submissions. Far in advance is good for delegating processing time properly.

Follow Up from a Professional Perspective

If your claim is still not paid just in time, follow it up with a polite email that would contain all appropriate references and date of submission.

Also Read: How Can a Premium Payroll Service Benefit My Business?

Common Pitfalls

Missing Information

Please make sure you fill in everything that is required. Missing information is by far the most common cause of delayed claims in Singapore.

Late Submissions

Many organizations will place tight deadlines on claim submissions, usually from 30 to 60 days post-expense. Late filings might be outright rejected as a result.

Whimsical about Documentation

Provide the context to the expense. A short note to explain just what part of the business it was for could go a long way in avoiding back-and-forth for what essentially just needed a simple explanation.

Final Thoughts

Mastering the reimbursement claim process takes time, but with proper organization and attention to detail, it becomes much more manageable. Remember that accuracy and timeliness are key to successful claims processing in Singapore’s efficient business environment.

Keep this guide handy for your next claim submission, and you’ll find the process much less daunting. Remember, when in doubt, it’s always better to provide more documentation than less – your future self will thank you for being thorough!