Ever wonder why one of the most successful social security systems in the world belongs to Singapore? It’s in a well-structured CPF allocation that helps citizens build a nest egg. Let’s jump into such a spirited system that has been securing financial futures since 1955.

Understanding CPF Allocations: The Basics

Think of your CPF allocations as an orderly financial garden – a garden in which every little part has been tended against the heat of sun or rain to help your future security blossom. The scheme, hatched by the Central Provident Fund Board, gives Singaporeans an avenue toward fulfilling their retirement, housing, and medical needs.

CPF Allocations And The Three Pillars

1. Ordinary Account (OA)

Your OA is indeed an all-rounder that assists with:

- Housing payments

- Investment opportunities

- Education expenses

- Insurance premiums

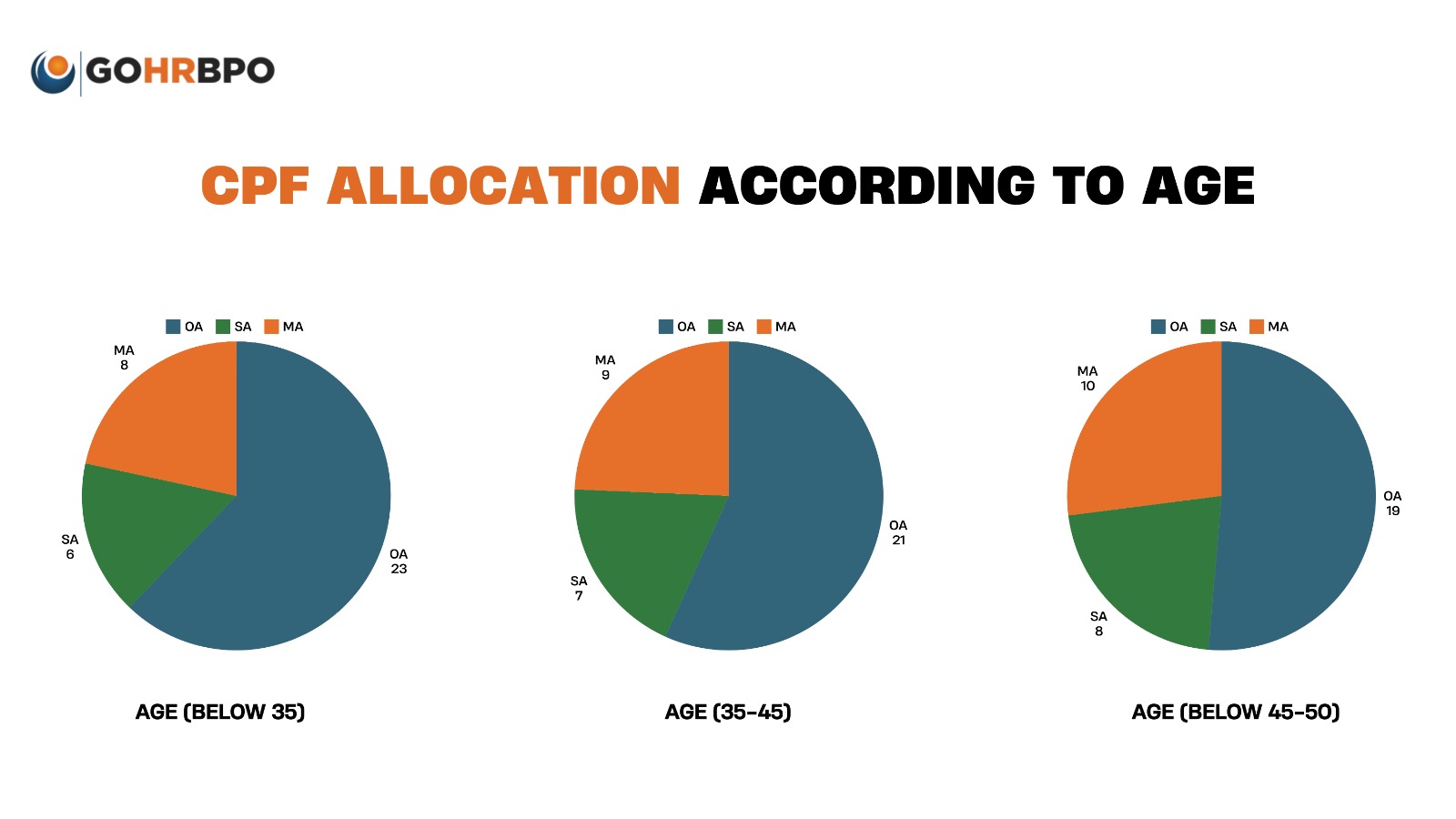

Current allocation for below 35 years:

- 23% of your monthly wage

- Just right for those little dreams of buying a home!

2. Special Account (SA)

Consider this your retirement bestie:

- Higher interest rates (up to 5% per annum)

- Strictly for retirement planning

- Investment options in retirement-related financial products

3. MediSave Account (MA)

Your health’s financial caretaker:

- Medical insurance premiums

- Hospitalization expenses

- Approved outpatient treatments

- Long term care needs.

CPF Allocations and How To Make Them Work Smarter

1. Intelligent Investment Strategies

You may put your funds from either your OA or SA into:

- Unit trusts

- Insurance-linked investment products

- Exchange-traded funds (ETFs)

- Singapore Government Bonds

2. Housing Optimization

Prior to utilizing OA for housing purposes:

- Appraise the sacrifices made to the loans of housing as compared to retirement savings.

- Plan for future mortgage payments.

- Familiarize yourself with the criteria that determine eligibility for HDB loans.

3. Healthcare Planning

Maximize your MA through:

- Routine health screenings

- Preventive care

- Grasp the coverage of MediShield Life.

Also Read : Tips for Accurately Filling Out the 2024 IR8A Form

Common Misconceptions About CPF Allocations

- “My CPF is locked away forever.” No! You can access different amounts at different occasions of your life course!

- “I can’t touch my CPF until I’m 65.” Not exactly so! Some schemes allow for early access for the purpose of meeting specific needs.

- “The returns on my CPF are low.” With guaranteed interest rates as high as 5% (SA), it’s actually quite competitive!

CPF Allocations: Pro Tips On Maximizing Your Funds

-

Top Up Strategy: You can think about putting in some voluntary contributions to maximize tax relief and help boost retirement savings.

- Housing: The balance between the contributions made to the OA for housing and the need to maintain some level of saving for retirement.

- Periodic Reports: Supervise all allocations and further adjust investment strategies.

Digital Tools for CPF Management

The above will assist in keeping one updated with one’s CPF allocations:

- CPF Mobile App

- MyMoneySense Portal

- CPF Retirement Calculator

Also Read : How to Calculate Salary from CPF Contribution: A Singaporean’s Guide

CPF Allocations: Effect on Different Life Stages

1. Young Adults (20-35)

- Focus on building OA for housing.

- Start early planning for retirement.

- Consider voluntary contributions.

2. Mid-Career (35-50)

- Balance between housing and retirement.

- Maximize returns in a special account.

- Plan for the children’s education.

3. Pre-Retirement (50-65)

- Review retirement sums.

- Consider CPF LIFE options.

- Plan for health care needs.

Conclusion

To better understand and manage your CPF allocations in order to get the most out of this great system, you might consider talking to one of the financial advisors at Recruitment Central. They can help you see how CPF allocations fit into your broader financial planning and transition strategies, for instance, during employment changes or as you plan for the big move.

Being in the driver’s seat of the financial future starts right now-your future self will appreciate your shrewd decisions in handling your CPF allocations!