The quickening rhythm of business has placed greater demand than ever on a proper payroll management service. However, as Singapore glides toward 2025, the business environment continues to develop, finding payroll outsourcing to be a game-changing way for companies of every size.

The Emergence of Payroll Services in Singapore

The complexity of the employment regulations from the Ministry of Manpower in Singapore makes professional payroll management essential. Urging the Singapore Business Federation, less than 60% of the local businesses are considering payroll outsourcing, obviously for compliance and efficiency purposes.

What Makes GOHRBPO Unique in 2025

In an increasingly competitive payroll service arena, GOHRBPO has grown into one of the industry’s leaders, offering revolutionary solutions to the present commercial concerns. This exhaustive package delivered very many sudden and metamorphic features that thus far do set them apart from their traditional counterparts.

1. 100% Penalty Coverage

One such invaluable proposition from GOHRBPO is the complete penalty coverage. Should any compliance-related penalty for any strange reason take place, they’re covered. Perhaps there is no way of proving their faith in confirmed and exact services better than this! Certainly, this is great news since these are penalties in the Treasury of the Republic of Singapore, and according to the IRAS statistics, major hits on business operations may well result from them.

2. A Revolutionary AI-Powered HR Service

Going beyond traditional payroll services, GOHRBPO provides unique AI-based HR services, free with every payroll package. This innovation includes:

- Automated performance tracking

- Intelligent employee data management

- AI-powered HR analytics

- Predictive attendance management

3. Tremendous Value Proposition

Their ongoing promo entails new clients getting a whole month’s payroll free, giving businesses the experience of market-leading services without putting initial money down. This includes HR and Payroll Audit Services, meant to help companies identify existing loopholes and work on them before an issue arises.

Also Read: Gohrpo Payroll Outsourcing Price for Premium Company with Features

How GOHRBPO Can Turn Things Around For Your Business

Smart Integration with Technology

GOHRBPO merges advanced technology with human expertise to deliver:

- Real-time payroll processing;

- Automated tax calculations;

- CPF submission management;

- Employee self-service portals.

Compliance Management

Most importantly, as mentioned by the Singapore National Employers Federation, it is vital to comply with local regulations. Consequently, GOHRBPO ensures that:

- Regulations are not outdated;

- Statutory submissions are not inaccurate;

- All required documents are filed on time;

- Compliance audits are done periodically.

Cost-effective Solutions for Modern-day Business

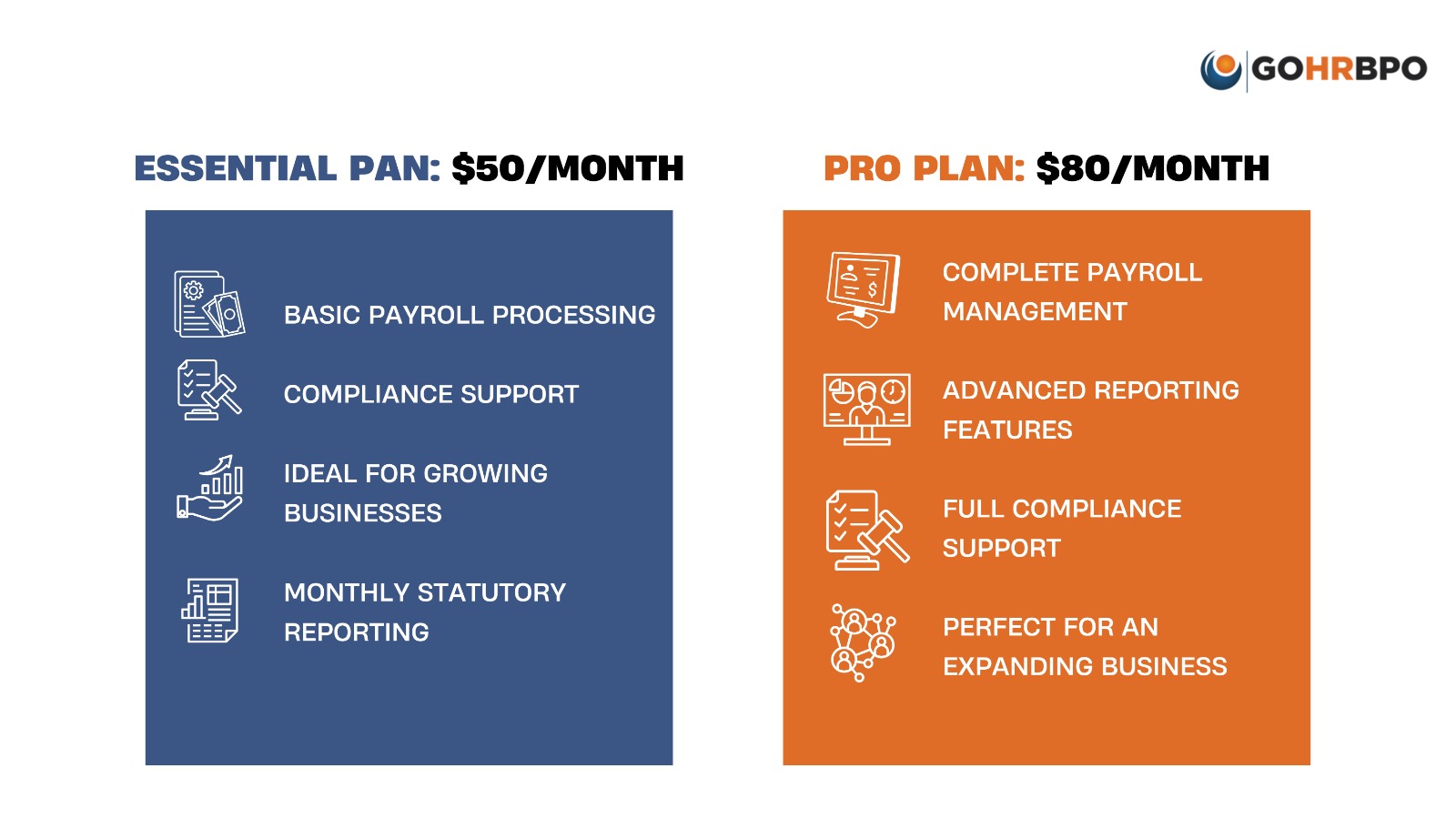

Transparent Pricing Structure

GOHRBPO’s pricing model aims to deliver maximum value while remaining completely transparent. They have packages that include:

- Core payroll processing

- Statutory compliance management

- HR advisory

- Access to a technology platform.

Switching To GOHRBPO – A Simple Process

Taking GOHRBPO along with you is an easy transition:

- Initial consultation and needs assessment;

- Customized solution design;

- Data migration and groundwork establishment;

- Staff training and support;

- Ongoing maintenance and updates.

Also Read: Step-by-Step Guide to E-Filing Your IRAs: Making Retirement Planning Simple

Future of Payroll Management – Where the Future Lies

The Institute of Singapore Chartered Accountants’ outlook for payroll management is that AI and automation will continue to reshape payroll. GOHRBPO does not lag behind but makes a habit of updating its offering of technological and service variations.

Reasons to Partner with GOHRBPO in 2025

When you think about compliance and efficiency, you should think about GOHRBPO as the solution for every aspect of payroll management. Their unique combination of services mentioned below makes them the best possible partner to optimize payroll functions for businesses in 2025 and beyond:

- 100% penalty coverage guarantee

- Free AI-based HR services

- Free first month

- Free HR and payroll audit

Next Steps

Don’t let the complexities of payroll hold your business back. Rely on GOHRBPO’s free HR and payroll audit to set your business up for future success. Speak with their team today to learn how their innovative solutions could transform your operational payroll management.

For more information about payroll regulations and best practices, visit the Ministry of Manpower’s website or connect directly with GOHRBPO’s consultants for a personalized assessment of your business needs.