Beginning a business in a very vibrant entrepreneurial platform like Singapore is thrilling but payroll management still has to be one of the toughest aspects for a new business owner. Next to what probably is forecasting into 2025, payroll management is nowadays crucial for success in a startup. This guide takes you through all critical setups while unlocking insights on how GOHRBPO will change how you work with payroll.

A Peek Into Singapore’s Startup Payroll environment

The startup ecosystem in Singapore mandates careful attention to payroll compliance and regulations. From CPF contributions and taxes, every startup sees themselves grappling with any number of financial obligations. Inevitably, the complexity of such obligations surprises rookie business owners, making support from the professional world that much more valuable.

GOHRBPO: Your Payroll Partner at the Startup Level

GOHRBPO has established itself as the top outsourcing payroll service provider for Singapore startups. Their payroll management solutions, which ensure complete compliance without entrepreneurs ever having the need to worry, allow them to concentrate on growing their business while at a standard pace. Startups can stay away from common pitfalls with the help of GOHRBPO’s experience while remaining perfectly in alignment with regulatory perspectives.

They include:

- Payroll through to payroll processing

- Statutory compliance management

- Employee self-service portal

- Real-time reporting

- Tax filing assistance

Also Read : The Essential Guide to Regulatory Compliance

Startup Payroll Services: Essential Steps for Startup Payroll Management

Setup of Payroll Structure

For an effective payroll management system to function, clearly defining the structure and policies is important. These include salary ranges, schedules for payment, and benefits packages. GOHRBPO works with startups to create full-scale frameworks that will meet both current needs and allow for future growth.

Understanding Compliance Norms

Given the regulatory state in Singapore, there have to be strict compliance requirements. GOHRBPO ensures that your startup conforms to the rules of the Central Provident Fund contributions, tax reporting, and foundation rules stated in the Employment Act. They keep abreast of recent regulatory changes so goodbye compliance issues for you.

Technology Integration

Modern payroll management requires robust technology. GOHRBPO has an updated model that facilitates cloud access, automatic calculations, and seamless integration of HR functions. Such technological support guarantees accuracy while at the same time saving much time and expense.

Startup Payroll Services: The GOHRBPO Advantage

Cost Efficiency

Startups need to be particularly careful when spending money. By eliminating:

- Payroll employees on full payroll

- Costly licenses for some software programs

- Training and development spending

- Infrastructure investments

Expert Support and Guidance

Throughout the startup journey, GOHRBPO takes care of your entire payroll process with the help of a specialized team. They offer personalized consultations, periodic guidelines to keep your operations compliant, and efficient customer support for seamless payroll operations.

Planning for Growth

As your startup grows, your payroll requirements expand and evolve along with your business. GOHRBPO solutions are scalable and designed to grow with your business, add more complexity, and crank up the volume. Their flexible model ensures that you get adequate support at every step of your business growth.

Also Read: CPF Allocations: A Path to Financial Security

Navigating Common Challenges

The startups have their own set of payroll challenges, from accommodating variable compensation to dealing with equity-based payments. Having this expertise from GOHRBPO will help you navigate through these complexities without losing compliance and efficiency. Their proactive approach will help avoid troubles from becoming big.

Successful Best Practices

A successful payroll process involves an eye for detail and regular checks in place. GOHRBPO advises keeping clear lines of communication open, maintaining accurate records, and regularly reviewing payroll policies. They help implement these best practices and offer support throughout this process.

Future Landscape: 2025 and Beyond

Future is dawning swiftly upon startup payroll services with ever-advancing technology. GOHRBPO keeps up with the trends and develops their services with AI-led analytics, heightened automation, and mobile-first solutions. This fountain of insight prepares the ground to ensure that your startup can, and will, take the first step ever, propelling one into modern payroll management.

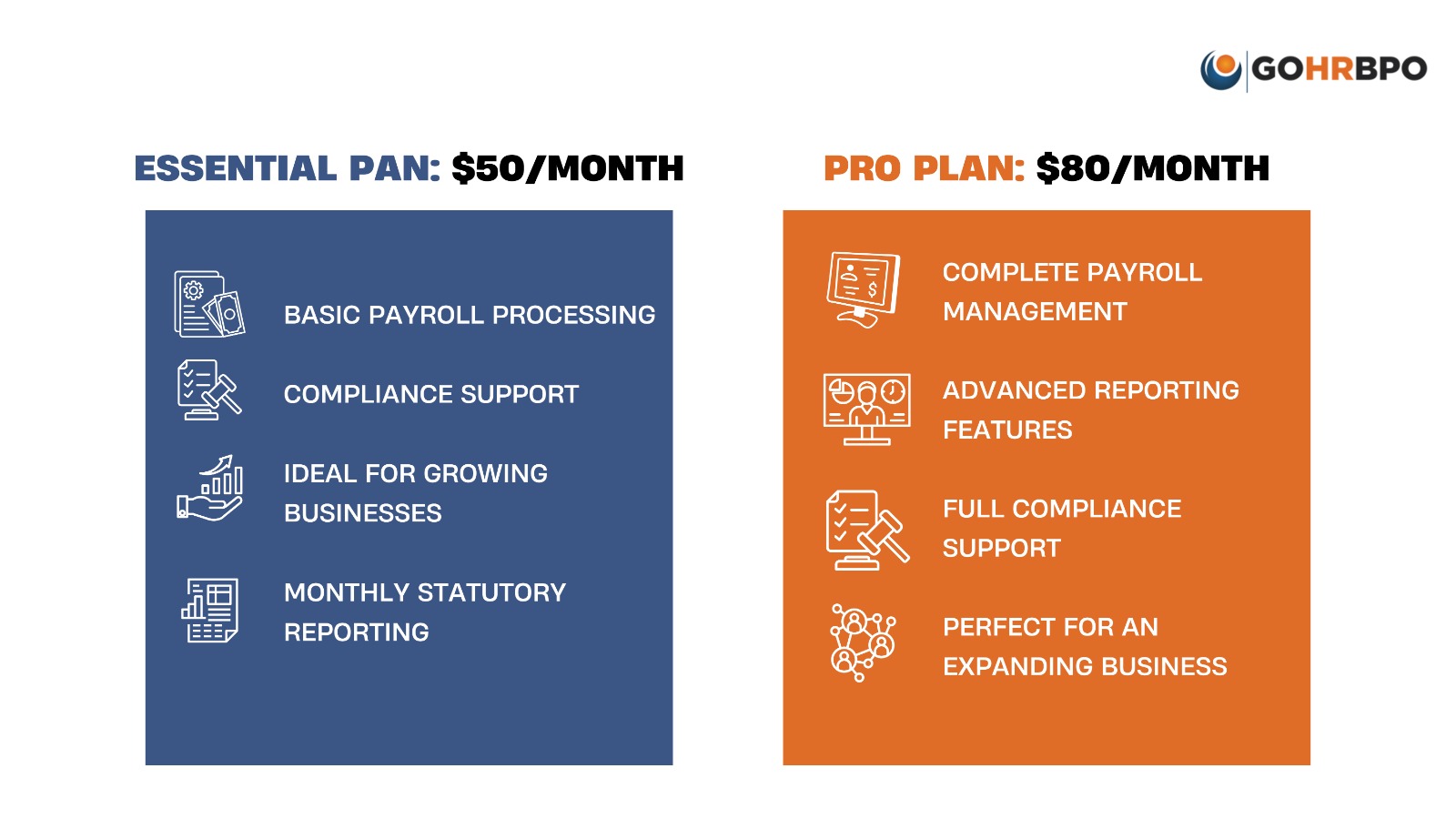

The Special Startup Package by GOHRBPO

Understanding the unique needs of startups, GOHRBPO offers a comprehensive startup package that includes:

- Full payroll processing services

- Compliance monitoring and reporting

- Employee self-service portal access

- Regular consultations

- Customized growth planning

Exclusive Benefits:

- 100% Penalty Coverage Guarantee: GOHRBPO provides complete coverage for any penalties imposed, ensuring your peace of mind

- FREE AI-based HR Services: Get complimentary access to cutting-edge AI-powered HR services every month with your payroll package

- 1 Month FREE Payroll: Start your journey with GOHRBPO by enjoying your first month of payroll services absolutely free

This risk-free package demonstrates GOHRBPO’s commitment to supporting Singapore’s startup ecosystem while providing enterprise-level payroll solutions that grow with your business.

Resources That You Find Helpful