The property market of Singapore has always been undulating; the Additional Buyer’s Stamp Duty (ABSD) has always been one of the most important cooling measures influencing investment strategies and home ownership practices. Into 2024, knowing about the latest developments in ABSD for local and foreign investors is increasing in importance.

An Update on the ABSD Rates in Singapore

As communicated by the Inland Revenue Authority of Singapore (IRAS), a number of significant changes in the rates of ABSD have been made by the government to enhance the stabilization of the market. Latest amendments addressed that in a bid to promote sustainable growth in the Singapore property market while enabling their citizens to own property, Singapore would increase the ABSD rates.

ABSD Singapore 2025 Current Rates for Different Buyer Categories

As provided by the Singapore Land Authority (SLA), ABSD rates are:

For Singapore Citizens:

- First residential property: No ABSD

- Second residential property: 20%

- Third and subsequent properties: 30%

For Permanent Residents:

- First residential property: 5%

- Second residential property: 30%

- Third and subsequent properties: 35%

For Foreigners:

- Any residential property: 60%

Also Read : PSG Grants: A Pathway to Innovation and Growth

ABSD Singapore 2025: Understanding the Impact on Different Buyers

First-Time Homebuyers

First-time citizen home buyers enjoy the most favorable position, with no ABSD payments due. However, a few things need to be focused on by the Urban Redevelopment Authority (URA):

- Effective financial planning.

- Understanding TDSR.

- Will market conditions be favorable in the future?

Property Investor

In turn, the graduated ABSD rates greatly influence investment decisions. According to the Monetary Authority of Singapore (MAS), these measures look to:

- Encourage sustainable growth in the property market.

- Prevent speculative practices.

- Prevent any market destabilization.

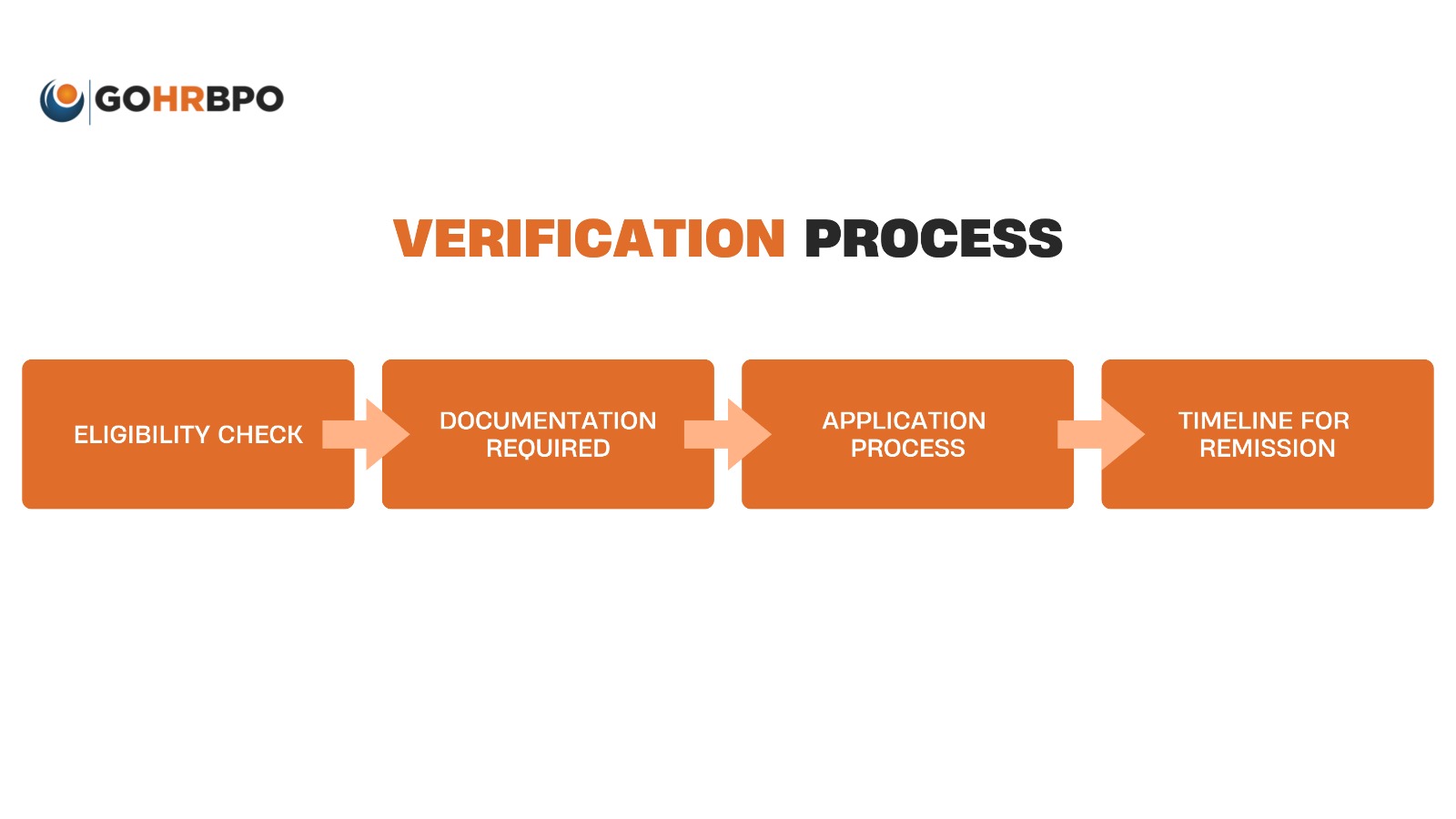

ABSD Singapore 2025: Key Exemptions and Reliefs

Married Couples

Such a married couple, with a minimum of one Singapore citizen, may receive ABSD remission upon the following:

-The sale of the house and property must take place within 6 months of the marriage.

-At least one of the spouses must not have any other residential properties.

-The property must be jointly acquired.

Special Cases

The Ministry of National Development specifies a few special cases:

-Inherited through testamentary dispositions and court orders;

-Properties granted through court orders;

-Certain embassies and international organizations.

Strategic Considerations for Property Buyers

1. Timing Your Purchase

The property veterans of the Singapore Real Estate Exchange suggest considering:

- Market cycles and seasonality

- Interest rate trends

- Personal financial readiness

- Long-term property goals

2. Financial Planning

In factoring in ABSD costs, buyers should:

- Carefully calculate all the other costs linked with the purchase of any property along with other stamp duties

- Consider easily-fundable options

- Prepare to take market changes into consideration

- Assess how long they can hold property over a period of time.

Also Read : What Are the Different Types of IRAS in Singapore?

Conclusion

Understanding ABSD Singapore regulations is crucial for making informed property decisions. Although cumbersome regulations tend to put limits on access, they strictly serve to stabilize the market and usher sustained growth in Singapore’s property sector.

Property buyers and investors need to keep up to date with ABSD regulations and work with qualified professionals so that they can best navigate these requirements. With Singapore’s property market likely to continue evolving, it is all the more important to keep abreast of changes in ABSD regulations and develop an understanding of how these affect property transactions.

Heed frequent checks from government channels for updates and talk with property professionals as a consideration before taking major steps.