Introduction

Payroll is one of the most important aspects of a growing business. It involves a lot of rules and regulations that a company has to follow. And in Singapore, it is about following the rules to the letter.

You have MOM insisting on itemised payslips, CPF contributions that have to be correct, and IRAS filings that can’t be late. If you miss any of these, the end consequences are not small.

If you are an SME and you are trying to handle all of this manually, I salute you. You are doing a full-time job of just managing payroll. I mean, spending hours managing spreadsheets and taking the risk of mistakes, and don’t even get me started on the stress.

But let me tell you the solution to your problems. It is outsourcing, payroll, outsourcing, payroll hand over specialist who takes care of everything from payslips to tax filing.

This way, you get accurate compliance and fewer costs. And most importantly, peace of mind.

Why is In-House Payroll Challenging?

Managing payroll in-house usually creates more problems than it solves. Here is what I mean:

- Compliance Risks: CPF rates, IRAS deadlines, and MOM rules change often. If you miss any one update or deadline, you could be fined up to S$5000.

- Time Drain: for most SMEs, it is the manual calculations and duplicate data entry that takes most of the time every month. This is the time that can be used for business growth.

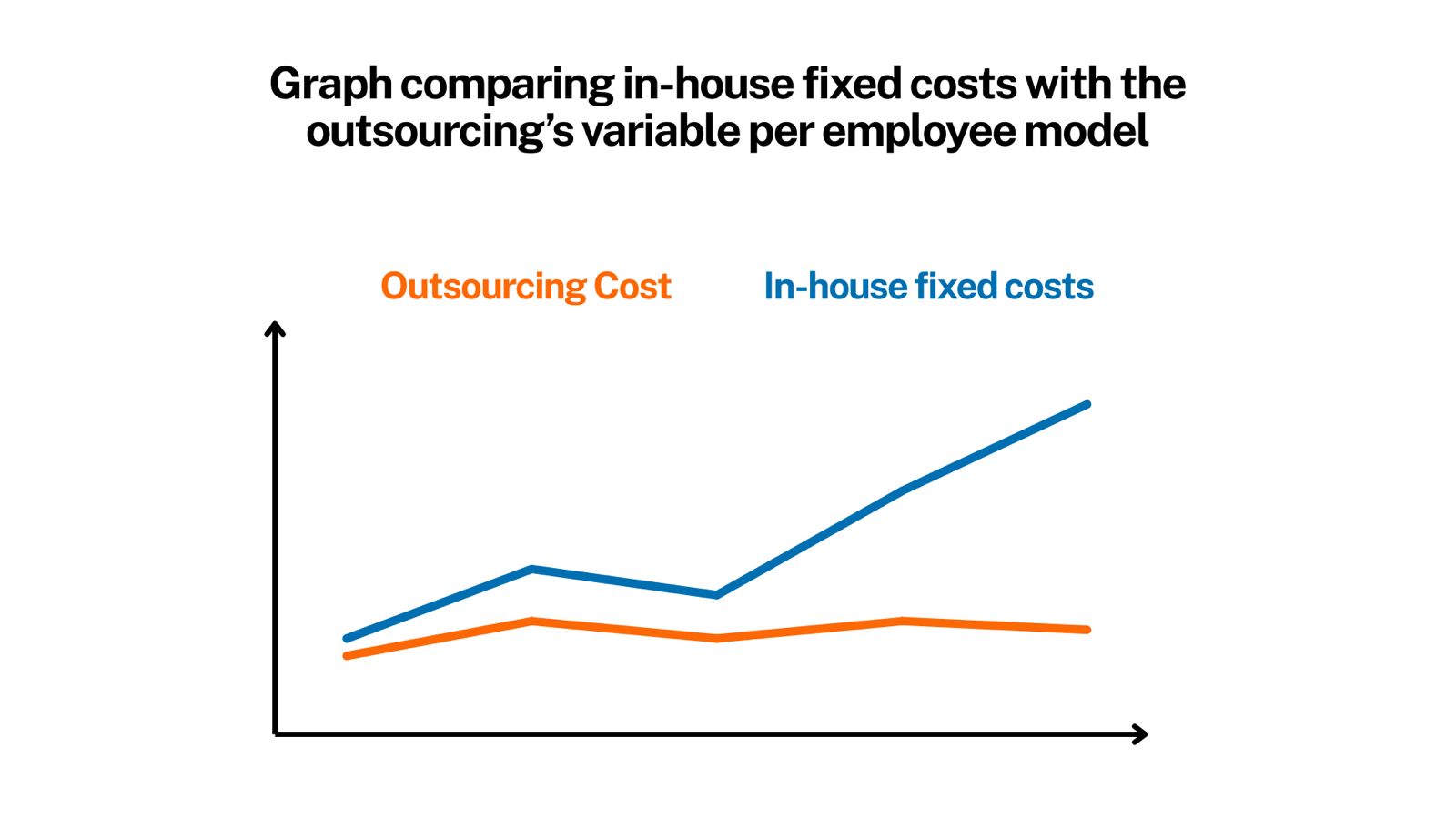

- High Cost: When you add up payroll staff salaries and software licenses, the total usually ends up higher than simply paying a per-employee outsourcing fee.

- Security Concerns: When you’re storing payslips and salary data in spreadsheets or basic tools, sensitive information is often compromised and exposed.

What End-to-End Payroll Outsourcing Covers

A good payroll outsourcing partner takes care of the whole cycle from start to finish:

- Salary Calculation and Disbursement: All of your salaries are calculated accurately, and all of your payments go out smoothly and on time, no matter if it is a GIRO transfer or preparing bank files.

- CPF, SDL, and Levy Submissions: all of these contributions are calculated accurately for you and filed without you having to track any change in the rates.

- Itemised Payslips: Every employee gets MOM-compliant payslips, which require no manual formatting

- Leave, Attendance, and Claims Integration: all your leave, attendance, and claims data is integrated into payroll straightaway, and you don’t have to re-enter any data.

- Annual IRAS Filing: Everything regarding your IRAS filing is handled and submitted on schedule.

- Tax Clearance: Even for foreign employees leaving the company, filings are prepared and submitted correctly.

Also Read: Key Risks in Payroll Outsourcing in 2025: A Singapore Perspective

| Stage | Tasks Handled by Provider | Output for Employer |

| Input | Employee data, hours, leave, allowances | Verified input sheet |

| Processing | Salary calc, CPF/SDL, deductions, GIRO file | Draft payroll summary |

| Compliance | CPF e-submission, IRAS AIS, and MOM payslip records | Statutory compliance |

| Output | Payslips, GIRO transfers, reports, IR8A forms | Employees paid, filings done |

Benefits of Fully Managed Payroll

- Compliance Accuracy: Your Outsourcing partners will stay updated with CPF ceiling changes and shifting IRAS rules. This way, all your submissions are on time and error-free.

- Time Savings: With an outsourcing partner, you will be able to save a lot of time because all of your payroll cycles will take just hours to finish, and not the usual days. In fact, most SMEs get back 10–15 hours a month.

- Cost Efficiency: You get outsourcing parents at around S$20–50 per employee each month, and it is often cheaper than paying full-time payroll staff plus software licenses.

- Error-Free Payroll: With such software, you get automation built in, and because of that, human error rates (which average around 3.7%) drop to almost zero.

- Data Security: Outsourcing providers run ISO-certified, PDPA-compliant systems with encryption and multi-factor login, which are a lot more secure than a spreadsheet that gets emailed around.

- Employee Experience: Staff get self-service access to payslips, leave balances, and tax forms anytime they want. It reduces questions to HR and builds more trust and transparency.

- Scalability & Insights: As the business grows, the service grows with you. A good sourcing provider handles more employees and even regional payroll. Plus, you get real-time payroll reports that help finance teams plan better.

Checklist: Choosing the Right Payroll Partner

| Feature | Why It Matters for SMEs |

| Local compliance expertise | Avoids CPF/IRAS/MOM penalties, ensures filings are correct |

| Transparent pricing | Prevents hidden fees, allows predictable budgeting |

| PDPA-compliant security | Protects sensitive salary and personal data |

| HR/Finance integration | Eliminates duplicate data entry, reduces errors |

| Self-service portals | Enhances employee transparency & trust |

| Scalable packages | Supports startups and growing SMEs without major overhead |

| Local support | Responsive help during payroll or filing deadlines |

Also Read: The Future of Payroll: Trends to Watch in 2025

Conclusion

To conclude, I’ll say that Payroll in Singapore can be complicated. You have to take care of CPF, IRAS, payslips, and all these things need to be done perfectly and on time.

When you outsource, all of that gets handled for you. For SMEs, that’s a big deal. You’re already doing great and dealing with growth and day-to-day challenges.

Handing payroll over to experts means knowing it’s done right every time, so you can put your energy into growing the business and supporting your people.