Venturing through the complex world of payroll management proves to be difficult for any business in Singapore. Moving on to 2025, payroll services have been transformed into sophisticated and highly streamlined benefits that save time, minimize human error, and act as compliance enforcers.

Understanding Fully Managed Payroll Services

To have a fully managed payroll means much more than the simple, mechanical numbers of employees’ salaries processed. This is a wholesome service that takes care of:

- Employee compensation calculations

- Tax Withholding

- Central Provident Fund (CPF) contributions

- Statutory reporting

- Compliance management

- Digitized record keeping

Fully Managed Payroll Service: Step-By-Step Process

Step 1: Initial Assessment and Onboarding

- The evaluation of the unique payroll requirements of your business starts with a thorough assessment:

- Payroll consultants often conduct detail discussions;

- Scrutinizing your current payroll processes;

- Spotting potential inefficiencies;

- Mapping out a tailored solution.

Step 2: Data Collection and Integration

Modern fully managed payroll services utilize technology to streamline data management:

- A secure cloud-based data upload;

- Integration with existing HR systems;

- Centralization of employee information;

- Multi-platform compatibility.

Also Read : Step-by-Step Guide to E-Filing Your IRAs: Making Retirement Planning Simple

Step 3: Accurate Salary Computation

Accuracy in payroll processing is crucial; a fully managed service ensures:

- Solid base salary calculations;

- Computation of overtime and bonuses;

- Monitoring of any variable-pay component;

- Compliance with the Employment Act of Singapore.

Step 4: Statutory Contributions

The regulatory environment in Singapore demands high levels of clarity and diligence on statutory contributions:

- Automatic calculations for CPF;

- Accurate withholding amounts for taxes;

- Compliance with work pass (EP, S Pass) requirements;

- Live compliance updates.

Step 5: Payroll Processing and Distribution

At the core of fully managed payroll services are:

- Automated salary payments;

- Multiple methods of payment support;

- Payments directly through bank transfers;

- Detailed payslip generation;

- Confidential and secure transactions.

Step 6: Reporting and Compliance

The need to stay ahead of the curve on regulations includes:

- Monthly and annual statutory reporting;

- IRAS compliance;

- Automatic tax filing;

- Comprehensive audit trails;

- Manage regulatory changes proactively.

GOHRBPO: Your Trusted Payroll Partner in 2025

GOHRBPO is very much distinct in the fully managed payroll service-industry by its provision for:

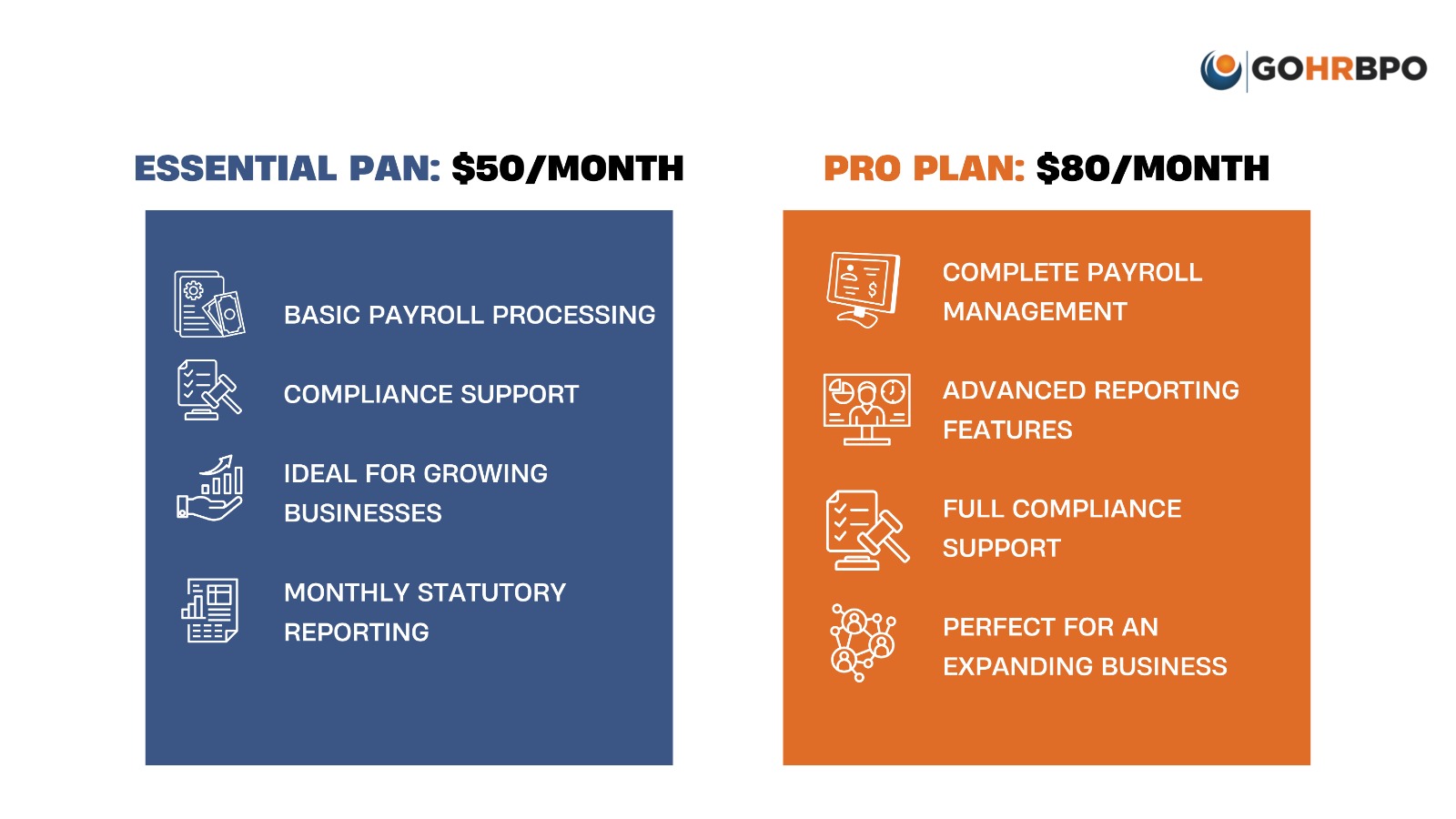

Pricing Packages

Essential Plan: $50 per month

- Basic payroll processing

- Monthly statutory reporting

- Compliance support

- Ideal for growing businesses

Pro Plan: $80 per month

- Complete payroll management

- Advanced reporting features

- Full compliance support

- Perfect for an expanding business

Key Advantages of GOHRBPO

- Insight into the payroll environment in Singapore

- Options using innovative technologies

- Transparent and affordable pricing

- Scalable services

- End-to-end security and confidentiality

Benefits For Your Business

While a fully managed payroll service can be beneficial to your business:

- Lower administrative costs

- Reduce compliance risks

- Increase operational efficiency

- Concentrate on core growth

- Provide payroll expertise

Also Read : CPF Rate Singapore | How Much CPF Contributions To Pay

How To Choose a Payroll Service Wisely

When selecting a fully managed payroll service:

- Identify specific business needs

- Assess technical capabilities

- Establish vendor compliance expertise

- Consider scalability

- Review pricing structures

Conclusion

The fully managed payroll service in 2025 is not just an option but an absolute necessity for choosing-wise businesses in Singapore. The nature of the company must ascertain the right provider for the payroll run from being a challenge to a manageable running process.